Breakout Trading: 7 Skills That Profitable Traders Share

There are many ways to trade, and each can make a living if used right.

Some people use breakouts as a prime trading principle, while others as a secondary one.

But where does the breakout stand in terms of the variety of trading approaches?

Trading strategies categorize as follows:

- Reversal

- Continuation

- Rebound

- Breakout

Here’s the weird thing about our perception in trading: the breakout can be part of each of the other three!

So, be ready to look outside the box when we look at different trading examples.

Next, we’ll thoroughly explore how and why breakouts work (and when they don’t!).

Let me give you some warning.

There’s no lack of information about the breakouts on the web; however, most still lose money trading breakouts.

Why?

It takes certain mental skills to get consistent profits from trading breakouts.

You may acknowledge everything you need.

However, in the heat of the moment, you’re likely to see things differently and act contrary to what works in the long run.

Only when your mindset and habits align with the truths about breakouts will you end up in green after a series of trades.

So, the article won’t be merely a manual on trading breakouts.

We’ll learn how to level up our mental game, which is like glue, syncing what we believe with what we do.

Buckle up, and let’s get to the basics first.

What is a breakout in trading?

Quite a self-explanatory “breakout” implies that something breaks through a sort of an “obstacle.”

In trading, that something is the market price, while the obstacle is the price level.

Have you heard about the support and resistance?

Both are price levels!

Let’s see the example.

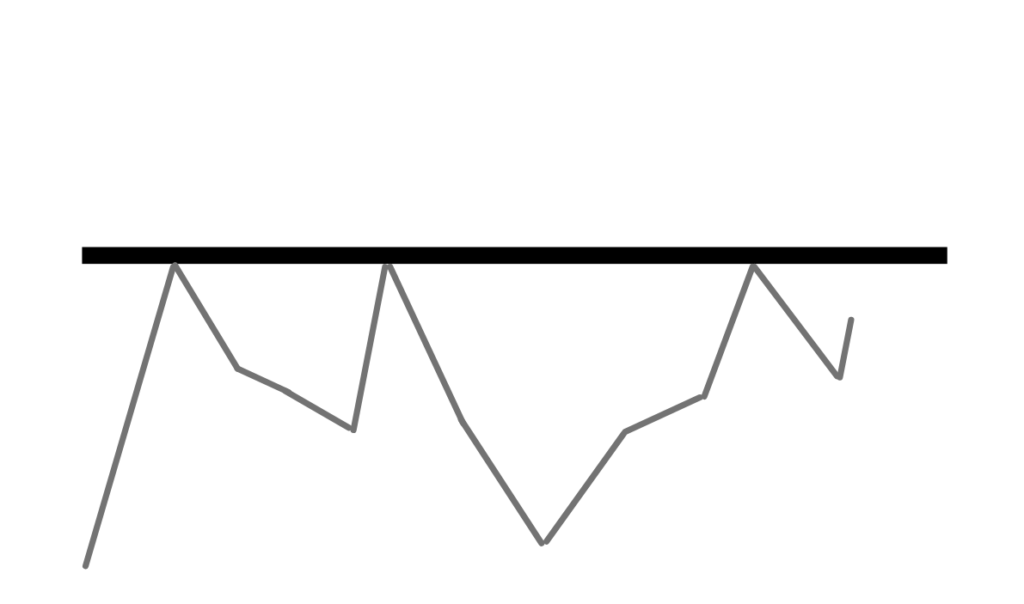

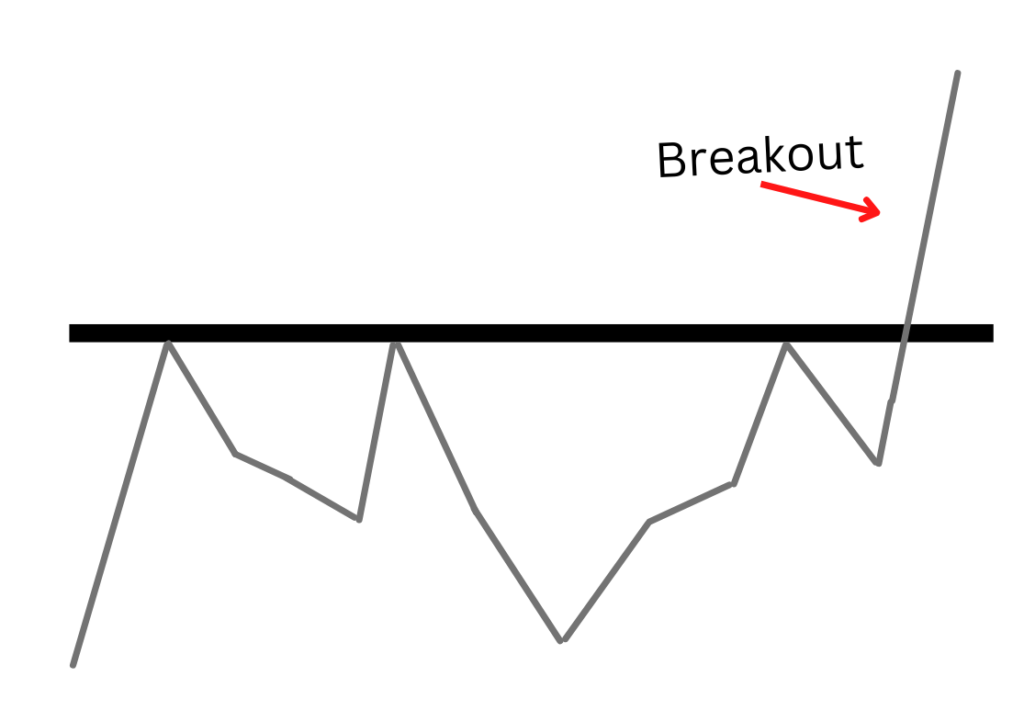

The image above shows the market touching several times a particular price area.

The breakout happens when the market manages to get through that area.

When the price level breaks, we often see a strong impulse.

The breakout is genuine if the market stays beyond the broken level.

So, what’s in it for you?

If the prices can’t get back within the old boundaries, the market is likely to keep going in the direction of the breakout.

Look at that move!

Moreover, the breakout may be the point of no return, with the market moving far beyond the broken price level.

Why do breakouts happen?

Price levels are spots of heightened interest from buyers and sellers.

We don’t really need to know the reason why they’re ready to trade at specific prices.

What matters is that we know that around those prices, many people are eager to do something.

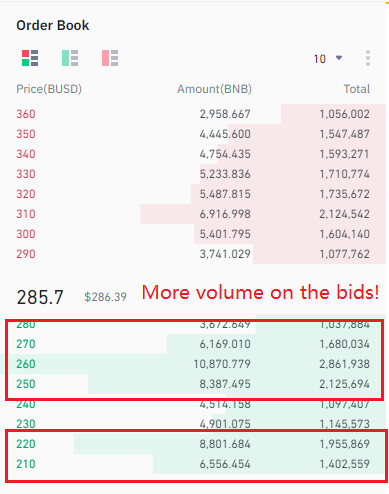

Many of those participants are speculators, trying to buy above the support, setting stop losses below the price level.

Once there’s a transaction at the stop loss price, the sell market order is activated.

Why would they do that?

If the sellers manage to fulfill all the bids at the support and even below it, there’s no point in being a buyer anymore.

You’d be a buyer because you assume that the path of least resistance is upwards.

The volume on the bids is “thicker” than the one on the asks on the way to your price target.

If the market proves the opposite, you should be out of there!

Many people would try to close their positions after the support is broken, creating a strong downward impulse.

Is breakout strategy profitable?

Suppose you build a trading strategy around breakouts.

What would make it profitable?

The breakout-based entry is just a tiny part of the puzzle.

What makes the whole strategy profitable is the combination of factors.

What are they?

Here are the main elements.

- The setup conditions

- The entry trigger

- Exit rules – for losing and profitable trades

- Position sizing

For example, you got in the breakout right in time.

However, if you don’t have a plan for how to take profits, you can even end up losing money.

Also, you can have good entry and exit plans, but betting too big wipes you out.

A breakout strategy is profitable when all parts of it are calibrated to limit the risk and maximize profits.

The profitability lies in details!

How do you make a trade on a breakout?

Generally speaking, you buy above the resistance or sell below the support.

There are several ways to enter the breakout, each having its pros and cons.

Below are three major ways to get in.

The earliest entry at the impulse

Here we buy once the market makes a few ticks above the key resistance.

Usually, traders use stop orders to enter such breakouts.

Check the example below.

Let’s consider two sides of it:

Pros

- Not time-consuming

- Aims to catch the very beginning of the move

- It can be a point of no-return

Cons

- High risk of entering a false breakout (we’ll look into it later)

Traders can catch a big move without even being at the desk.

Although, depending on your stop-loss tactic, the win rate tends to be around 30% or lower.

Entry at the retest

The retest happens when the price gets back to the broken key level not long after the breakout.

After the first signs of the move continuing toward the direction of the breakout, traders enter, hiding stops behind the swing.

Here are the strengths and weaknesses of such an entry.

Pros

- Good risk-to-reward on the trade

- Less likelihood of being stop-hunted

- More time to open a position

Cons

- The chance of missing powerful breakouts without retests

Did you know that, according to Bulkowski, there’s a 60% chance of a retest?

Thus, it makes sense to wait for one.

However, if you tend to beat yourself up over missed moves, consider including an entry at the impulse.

Entry at the candle’s close

Have you ever heard “professionals trade at the close”?

Initially, it was meant that it’s wise to open a position at the close of the trading day.

Here’s an example in the daily chart.

Why does it make sense?

Traders that use daily charts to open positions need the most recent, complete information to be objective.

Once the daily candle closes, it becomes unchangeable on the chart, setting the piece of market information in stone.

Only after we can be sure that the situation won’t change at the last moment can we act on the market signal.

When the upward breakout happens, traders wait until the candle reliably closes above the resistance.

The stop loss can be put under the breakout candle’s low or right below the support.

The opposite is true for broken support.

Such a method can be a compromise to the previous two, especially if you move to a slightly higher timeframe than your usual one.

Is breakout trading good?

Few things in trading should be seen as black and white.

The efficiency of breakout trading is quite relative.

The answer would depend on the following:

- The personality of the trader

- The type of market

Breakouts tend to fail quite often, so traders that don’t mind a big streak of small losses would do well.

Some markets have a character of price action that is more suitable for breakouts.

For example, stocks, commodities, and index futures tend to provide more reliable breakout entries.

Some breakout trading crypto strategies work well even in crypto, as the market is also very directional periodically.

Also, the sentiment matters.

When the market is “in-play” and driven by some common theme, breakouts will perform better even in Forex.

Summing up, breakout trading is suitable when a number of key factors are present.

What happens after a breakout?

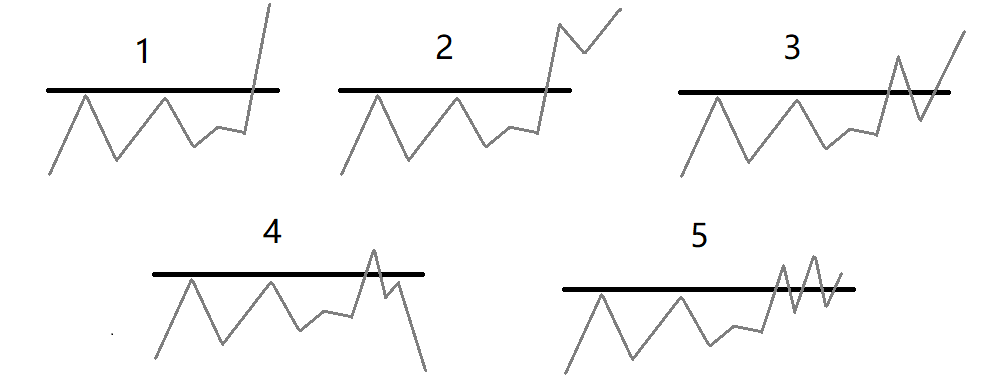

There are five main scenarios of the post-breakout price action.

Let’s look at them closer.

- No-return: The market keeps moving in the direction of the breakout without any pause.

Once you get in, the market never comes back to your entry price.

- Mild retest: After the initial breakout impulse, the market stalls and may form not deep pullback.

The pullback shouldn’t violate the broken price level.

- Deep retest: The pullback after the breakout is deep, often violating the price level.

- Trap and reversal: In the case of the bullish trap, the market returns below the resistance after briefly piercing the level. Often it provokes breakout traders to close their positions, causing a sharp decline.

The opposite is true for the bearish breakout.

- Choppy range: The market breaks the price level and starts ranging right in the key area, so it’s not clear if bulls or bears are winning.

Below are some visuals for each scenario.

The scenarios above range from the easiest (1) to the most complex (5) to trade.

When should you not trade breakouts?

Besides specific markets being less suitable, there are other “on the spot” hints of not trading breakouts.

Often these signs appear even in the most dynamic, breakout-saturated markets.

So, watch out!

Choppy instrument’s price action

Sometimes a particular contract, stock, currency pair, etc., behave in a way that’s not suitable for trading breakouts.

If there have been erratic moves with many long shadows recently, you should question whether it’s worth considering the instrument.

Here’s an example.

Why stay away?

If several previous breakouts turned out to be rough, what makes you think the market would treat you nicely this time?

The exception is zooming out to the higher timeframe and waiting for a breakout over there.

Again, make sure the instrument isn’t choppy on the larger scale as well.

Overextended move prior to the breakout

When the move proceeds without any significant pullbacks for a while, we may call it overextended.

Primarily it’s the case if the candles are bigger than usual.

Check this out.

Consider a bullish move.

The odds aren’t high that the market will continue grinding higher above the resistance right away after the breakout.

The resistance is the density of sell orders, where many bulls would want to take some profits.

That’s why it’s dangerous to buy the breakout right after an overextended move – you’d buy where many are getting out!

Below are two factors that make such moves a bad companion for breakouts.

1. Market gets thinner

Usually, the order book gets less saturated with pending orders as prices keep going in the same direction.

Why?

As the market keeps going further from “normal,” fewer new participants are ready to transact at extreme prices.

It’s easier to move the prices in the thin market, as it takes less capital to fill all the available orders at each price.

In such an environment, the pullbacks tend to be sharp due to a lack of big players to support (or resist) the market.

2. Traders get tempted

The further the market goes without pause, the more eager to get out would be those entered at the beginning of the move.

As people get more satisfied with the profits they see, they’d be tempted to cash out at the first signs of the reversal.

Low-volume market hours

The periods like lunchtime or holidays tend to be tricky.

Due to low trading volume, it’s easier to sway prices back and forth, causing false breakouts.

When should you buy breakout?

The bullish breakout works best when the conditions below are present.

For a solid setup, you need at least the first two factors to be there.

Chart evidence of numerous pending bids

When you buy a breakout, you need something that would keep the price from declining.

What could it be?

If there is a congestion of buy limit orders below the entry, sellers would need more capital to push prices lower.

Thus, you have a reason to believe bulls are stronger.

In the chart, such a situation is manifested in little pullbacks or consolidations right below the resistance.

Look at the circled area below.

As the market approaches the resistance, the highlighted area means that the attempts of sell-off were absorbed by bids.

There they are – hungry bulls!

That’s why you need that “tightening” to the critical level prior to the breakout.

Repeatedly tested price area

What happens when the market approaches some area several times?

Many would want to hide their stops slightly above the level and short the market.

Others would place buy stops to take advantage of the capitulating bears.

The more times the market tests the area, the more money is involved.

It’s like the market is accumulating power to eventually blow up!

The triggered stops cause an avalanche of buy orders, boosting the surge.

In-play sentiment

Events such as news releases, expectations, and narratives prompt people to buy regardless of the technical picture.

The news often enables the market to get out of the long consolidation.

Look what happened after the data release in Forex.

It’s crazy!

After the release, make sure you wait for at least 5 minutes before entering the market.

Otherwise, the spread can be very wide, making it impossible to control the risk.

Why do most breakouts fail?

Price levels form for a reason.

We don’t know how big the orders are of those who hold the price over there.

Other big players like to use breakout attempts to get some liquidity at better prices.

That’s why it’s pretty tricky to guess if the market has enough steam to sustain the breakout.

There are also no breakout trading indicators that can predict if the price holds.

Consider the price level as a wall.

It’s easier to jump off the wall than climb on it, isn’t it?

How many types of breakouts are there in trading?

In one way or another, breakouts can take different forms in countless market settings.

Based on the market context, there are two broad types of breakouts in trading:

- Continuation breakouts

- Reversal breakouts

Continuation breakouts happen when the trending market stalls for a while and then breaks out of the consolidation toward the trend’s direction.

Reversal breakouts occur once the market gets out of the range, moving against the preceding trend.

Note such breakouts don’t necessarily reverse the trend entirely but at least start a meaningful correction.

So, manage your expectations.

What is an intraday breakout?

When you zoom in, using the 1-hour timeframe or lower, you’ll be trading intraday.

The breakout principles are the same in any timeframe.

Sometimes there are unique intraday opportunities around specific assets, times, etc.

For example, you can build an intraday breakout trading strategy around Chinese stock indices.

In ChinaA50 and Hang Seng futures, the breakout tends to happen in the first 15-30 minutes after opening.

Look at the highlighted areas below.

Be careful, though.

When trading intraday, you’ll feel the effect of fees, spreads, and slippages more.

Also, you’re likely to use higher leverage to get meaningful results, which is fine.

The high leverage is riskier when there’s some accident involving the inability to control the risk.

Use stop losses and avoid market exposure during major news releases.

Your equity will thank you!

Summing up: 7 critical skills for breakout trading

We’ve looked at the intricacies of breakouts.

How to make money with breakout trading consistently?

Let’s go through the seven skills you need.

Check out more of the key traits of a successful trader here.

1. Patience

It all starts with the mindset of “I don’t have to take the trade.”

When you don’t feel like you’re obliged to trade, you’ll be free from FOMO.

Only in this way, your mind can utilize your market knowledge to enter where the odds are in your favor.

Makes sense?

Persevere to be mindful of your feelings when considering entering the market.

Is there any tension in your mind or even body?

Work towards minimizing such reactions.

You don’t expect your next trade to be the last one, do you?

2. Selectivity

Do you remember the criteria for a good breakout?

Professionals have a checklist for quality entry.

It doesn’t mean the setup must have all of them.

Otherwise, you’re risking passing on too many opportunities.

Stick with the criteria of a good and bad breakout that resonate with you the most.

Over time you’ll notice what works better in a particular market condition.

What matters is that you always know what you’re looking for.

You have immense freedom in the market, choosing what to trade, when, and how much to risk.

However, you risk being tossed around low-quality setups just because, at the moment, you “feel like it.”

On the other hand, searching for perfection, you can fall into analysis paralysis, not daring to trade at all!

Pick your poison!

Or, be selective!

3. Decisiveness

Usually, there’s quite a limited time to make the most valid entry at the breakout.

Especially if you want to ride the impulse, you need to be particularly precise.

After patiently waiting for the setup and checking all the criteria boxes, you need the guts to pull the trigger.

Are you still hesitating?

Think about what it will do to your trading in the long run!

Decisiveness must be developed until it becomes a habit.

Then, you won’t need much willpower to execute trades.

4. Resilience

Breakouts are not a high win-rate approach.

You should be mentally (and financially) prepared for losing streaks.

For example, with a 40% win rate, you’re likely to have up to 8 losses in a row over a series of 50 trades.

Think about what will happen to your judgment after a few losses.

Will you still follow the plan?

Will you pull the trigger?

It doesn’t mean you should relentlessly try harder; don’t push it.

A strategic timeout is essential for staying objective after a losing streak.

5. Flexibility

Although we went through various breakout scenarios, markets tend to act in the way one least expects.

Is it just me?

One scenario morphs into another.

Stop-hunting, news, heck, a new price level in the middle of nowhere – anything can happen.

Train your mind to consider various paths the prices may take.

“If-then” statements such as “If we close above X, then I’m long” is helpful in structuring your decision-making.

The more “if-then” scenarios you have (reasonable ones), the better.

6. Structured approach

The breakout setup checklist is only a part of the general plan.

Plan everything in your trading: routines, risks, market conditions, targets, etc.

When you have a structure in your process, it’s much easier to improve, tweaking stuff now and then.

For example, if you don’t make journal notes about your mistakes, you’ll quickly forget what you’re struggling with.

Eventually, the same issues keep repeating.

Also, when you know exactly what to do and when you’re saving mental energy.

How great it is to focus all your potential on the trading performance here and now instead of administrative tasks.

7. Understanding price action

As you see, the actual technical knowledge is at the last spot on the list.

Why?

Charts tend to play games with our minds.

Whatever you learn in price action, if you don’t have a plan and the proper mental habits, it’s useless.

It’d just be a fancy way to talk about markets but not actually profit from them.

Of course, price-action skills are a must.

But even if you’re Schumacher, driving with a dirty windshield is dangerous.

Happy trading,

Colibri Trader

P.S.

Have you checked my recent article on How to Trade the Double Bottom Pattern?