Breakout Forex Strategy- One Simple Strategy

What is the best breakout forex strategy?

Is there just one or many such trading strategies?

Trading financial markets implies risking parts of a trading account’s capital on expectations of capital gains.

Speculative in nature, trading brings together people from all walks of life: rookies

- professional investors

- quants

- retail traders that do this for a living

All of them aspire to find the holy grail in trading, which, for a lot of traders, relates to finding the perfect breakout Forex strategy.

Contents in this article

- The Perfect Breakout Forex Strategy

- What is the direction of the breakout?

- The Basis for a Breakout Forex Strategy

- How to Spot a Consolidation – Key to any Simple Trading Breakout Strategy

- What causes the breakout?

- Simple Trading Breakout Forex Strategy Explained – Bollinger Bands Used Properly

- GBPJPY Breakout Example – Forex Strategy Explained

- Using Triangles to Trade Breakouts

- Defining the Breakout – Key Element in Any Breakout Forex Strategy

- Interpreting a Triangle’s Breakout Using the Elliott Waves Theory

- Conclusion

The Perfect Breakout Forex Strategy

Get The Contracting Triangle Breakout Strategy PDF

Is there such a strategy?

A breakout implies the price will move fast.

Quick price action, in turn, suggests quick profits.

With one condition, though: to be on the right side of the market.

Having said that, it is also worth mentioning that many traders attempted to find a simple trading breakout strategy that works.

Early technical analysis pioneers tried to document consolidation areas, commonly forming before a significant breakout.

This is how patterns like contracting triangles, flags, pennants, and so on, formed.

Therefore, consolidations aren’t that bad in trading, as long as traders can label them appropriately.

More importantly, to trade them in the direction of the future breakout.

What is the direction of the breakout?

Trading breakouts is easier said than done.

It means that the traders need to know in advance the direction that the market will break out to.

Well, isn’t it this the very purpose of technical analysis?

To interpret patterns and historical price action and use the information to predict future prices?

I won’t show a particular breakout Forex strategy alone.

Instead, I’ll focus on interpreting multiple situations that help to identify a consolidation.

Second, to form a position before the potential breakout.

Finally, trade the market in the direction of the breakout.

A simple Forex strategy that follows such steps has more chances to survive the test of time. This article will share with you why.

The Basis for a Breakout Forex Strategy

Any investment bears a risk, not to mention any trading strategy.

Forex trading comes in various forms, with retail traders thinking that the market will always move.

Surprise, surprise, statistics show otherwise.

To the shock of many, the markets spend most of the time in consolidation.

Even when doing back-testing (i.e., testing a trading theory or idea on historical prices), many traders fail to consider the consolidation areas.

They focus only on the market moves, and that is normal because that’s where the profit is.

However, if the end of the consolidation catches the trader on the wrong side of the market, that’s a painful outcome for anyone’s trading account.

Important: The first element of a simple breakout Forex strategy is to identify a consolidation correctly.

Only by looking at a bunch of candlesticks with low ATR (Average True Range) won’t do the trick.

The idea is to focus on those consolidation areas that end with the strongest possible breakout.

Simple trading concepts like this here may sound weird.

But simple things work best, especially when trading such complex markets like foreign exchange.

How to Spot a Consolidation – Key to any Simple Trading Breakout Strategy

There are two ways to interpret a consolidation. Or, to expect one.

One way is to use fundamental analysis.

It is said that technical analysis shows the future market direction.

But, the fundamental analysis gives the economic reason why a market will move.

Therefore, any Forex trading strategy focusing on the breakout element must consider the reason why the range will break.

What causes the breakout?

We can open a long conversation here.

So many factors belong to the fundamental side of trading that there’s literally no point listing them all.

Fundamental Breakouts

I will just mention a few of them:

- natural phenomena (hurricanes, floods, earthquakes, tsunamis, etc.)

- political and geopolitical events (summits, elections, referendums, etc.)

- important economic data

Think of the NFP (Non-Farm Payrolls) week.

One of the most important economic data, the NFP comes out every first Friday of the month.

Because the Fed’s dual mandate focuses on job creation too, the release has a major impact on the U.S. Dollar.

Therefore, the entire Forex dashboard reacts, as the U.S. Dollar is the world’s reserve currency.

So, the chances to see a breakout on that particular NFP week are weak to extremely weak.

Traders won’t risk ahead of the release, so consolidation areas form on the major pairs (i.e., pairs that include the U.S. Dollar).

The same is valid with elections, referendums, or any event that makes the markets waiting for an outcome.

Examples like the Brexit vote, U.S. Presidential elections, etc., all caused months-long consolidation areas that ended with major breakouts.

Technical breakouts

The other way is to use technical analysis to spot consolidation areas. And, to trade them.

If fundamental analysis points to a breakout, technical analysis shows the direction.

Hence, traders need them both before deploying capital to any possible trading idea.

Simple Trading Breakout Forex Strategy Explained – Bollinger Bands Used Properly

Bollinger Bands are the perfect indicator to use for explaining breakouts. Or, more precisely, for trading breakouts.

Few traders know that they act as a breakout indicator too.

Because the standard interpretation doesn’t mention it, most traders use it as a trend indicator.

In other words, the three lines that make up the indicator contain the price for over ninety percent of the time.

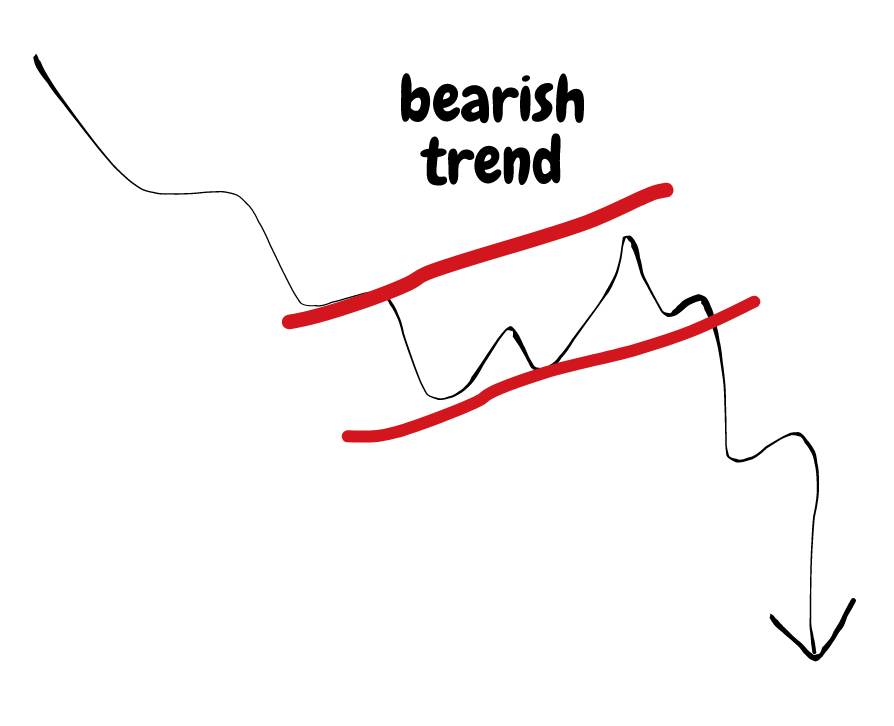

Therefore, traders consider a bearish trend when the price sits between the lower channel, respectively a bullish trend when it moves into the upper channel.

But what about focusing on the ten percent or so cases when the price moves outside the Bollinger Bands?

Isn’t that situation appropriate to consider regarding a breakout?

Besides being an excellent trend indicator, this indicator also addresses the market’s volatility.

The UBB (Upper Bollinger Band) and LBB (Lower Bollinger Band) do just that: reflect volatility.

More precisely, the wider the distance between the two lines, the higher the volatility.

Or, the closer the two bands are, the lower the volatility in that respective market.

Any trader knows that periods with low volatility form before major breaks.

The ability of price to break outside the range shown by the Bollinger Bands is a tremendous sign of an ongoing breakout.

If we add to this the fact that this is a dynamic range (i.e., follows the price action), we will see why the price tends to remain inside the bands for longer.

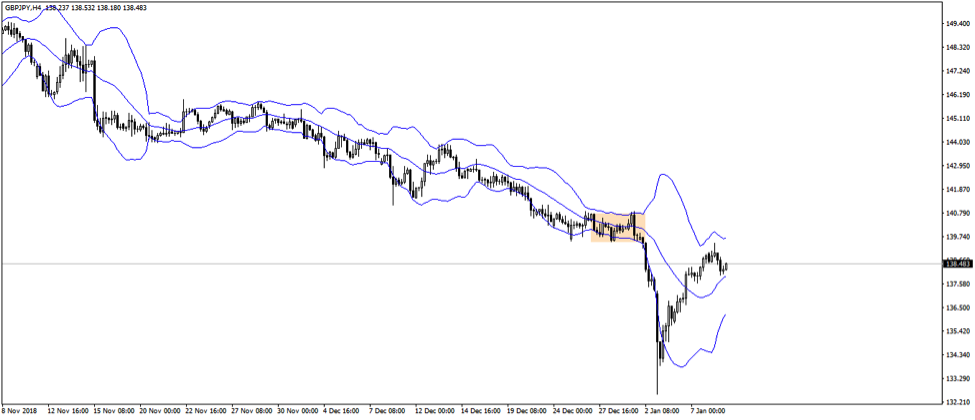

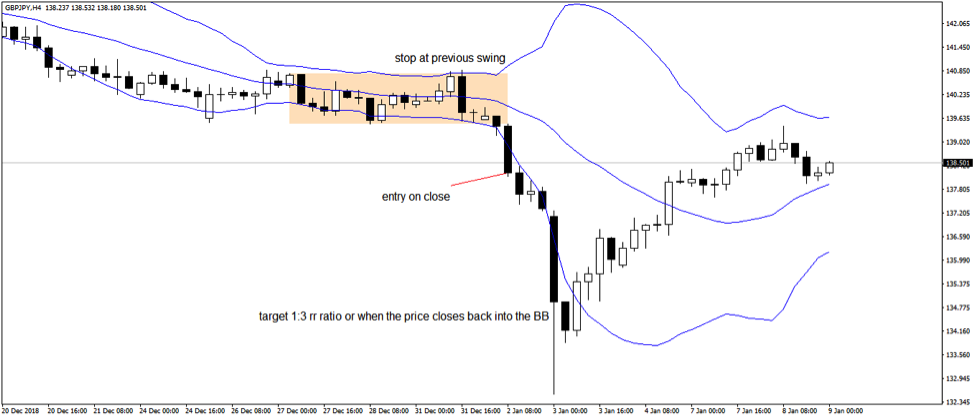

GBPJPY Breakout Example – Forex Strategy Explained

Examples offer a great way to tell a story.

And, in this case, I’ll use one of the most volatile pairs that are part of any Forex dashboard: GBPJPY.

Even though the below is an “after it has occurred” example, it will help you to understand:

- How Bollinger Bands works as a volatility indicator

- How to spot a consolidation

- What’s needed to consider a valid breakout

We mentioned earlier that the Bollinger Bands offer a dynamic range that follows the price carefully.

Therefore, rarely the bands spend time on the horizontal.

When that happens, though, and the UBB and LBB narrow down, it signals that:

- volatility is low

- an unusual range is forming

- a breakout is imminent

The definition for a breakout using the Bollinger Bands indicator is straightforward.

Put simply, the price must close below or above the LBB or UBB.

However, not every close is valid.

More precisely, the condition to look for is that a consolidation, as we’ve defined it earlier in this article, is present.

Just like in the chart above, where the yellowish area shows an almost perfect horizontal consolidation.

Simple Trading Solution for a Breakout

Remember: Any trade represents a probability event. The higher the probability is, the bigger the chance the trade will end up in profit.

In other words, a trader’s task is to identify situations when the odds favour a particular outcome.

That’s no easy task, as plenty of confusing elements exist (i.e., volatility, too many indicators, false breakouts, etc.).

If we zoom in on the previous example and follow everything discussed so far, the trading setup for such a breakout Forex strategy looks like below:

Let’s sum it up:

- make sure the UBB and LBB evolve on the horizontal

- the UBB and LBB need to be closer to one another than usual

- wait for the market to break and close below the LBB or above the UBB (being the 4h chart, there’s plenty of time to wait and analyse the setup properly)

- entry on close

- place a stop-loss at the top or bottom of the previous swing (e., highest or lowest point in the consolidation area)

- target 1:3 RR ratio or just stay with the price action that follows the breakout until the price moves back between the UBB and LBB range

Using Triangles to Trade Breakouts

Triangles are one of the most popular consolidation patterns.

As consolidations precede breakouts, traders like triangular patterns as they form before significant swings.

As it is always the case, patience is key in trading.

Depending on the timeframe, it may take a lot of time for the price to consolidate, and patience is not a virtue among retail traders.

Nevertheless, the principle explained for the rest of this article applies to all timeframes.

Hence, following the steps used in this breakout Forex strategy helps replicate it on lower timeframes too.

Rule of a thumb: Although these rules apply on all timeframes, I still believe that the higher the timeframe, the more accurate the signal is

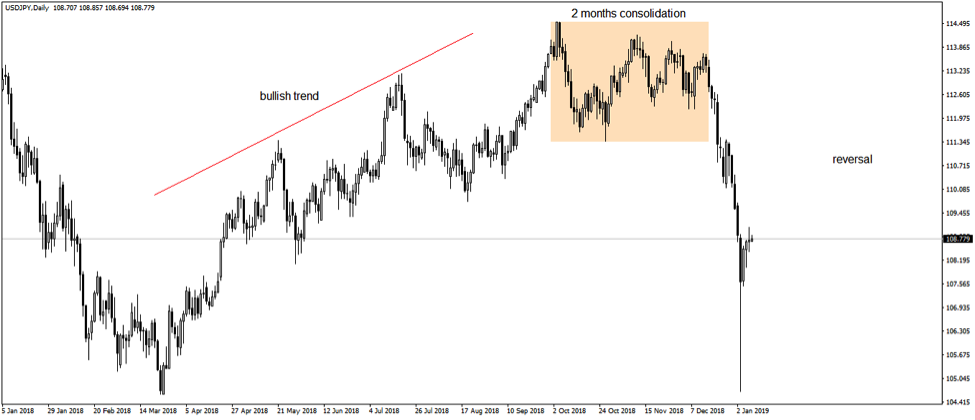

Below is the USDJPY daily chart. It shows the bullish 2018 price action when the pair rose from 105 to 115 following a by-the-book bullish trend.

As a reminder, a bullish trend’s main characteristic is the series of higher highs and higher lows.

It forms relentlessly, and its break signals the end of the trend.

At one point in time, the price action stalled.

It failed to make a new higher high, pointing traders’ attention to exhaustion.

This is the first sign of a triangular pattern.

A lot of most traders consider only triangles that act as continuation patterns (e.g., ascending and descending triangles).

Alas, the currency market forms many triangles that serve as reversal patterns.

After a two months consolidation (!) area, the price broke lower.

In fact, the breakout was so powerful that was dubbed as a “flash crash” by many currency traders.

In a low-volatility environment and with the Japanese market still on holiday, the JPY pairs dipped in early January 2019 trading.

However, savvy traders shouldn’t be surprised, as the real breakout happened much earlier.

More precisely, about ten trading days (or two full trading weeks) earlier!

Defining the Breakout – Key Element in Any Breakout Forex Strategy

Zooming into the consolidation area, the triangle becomes evident.

The two-month long price action forms lower highs and higher lows, pointing to an imminent breakout.

How do we know if the breakout happened?

At this point, we don’t even know if the triangle will act as a continuation or reversal pattern.

All that traders know is that the price was in a bullish trend for almost an year and suddenly it stopped and a triangle formed.

Using the same principle as in the Bollinger Bands example, a close below the triangle’s trendlines is mandatory.

The breakout, as it happened above, was bearish.

The price broke lower ten days ahead of the subsequent flash crash, and traders had all the time in the world to see it coming.

As the triangle broke lower after a bullish trend, the market tells us something and take action.

In this case, the triangle acted as a reversal pattern.

Even such triangles have a measured move.

The best way to interpret them is to use the Elliott Waves rules when interpreting contracting triangles.

Interpreting a Triangle’s Breakout Using the Elliott Waves Theory

One of the Elliott Waves’ rules states that the measured move of a triangle is the equivalent of its longest segment.

In this case, the longest section is the first one, making it the a-wave, according to Elliott.

In other words, the breakout not only showed the new direction.

It also warned about the upcoming melt-up of the JPY and provided the proper count for the entire pattern.

As the chart from above shows, the market formed a double combination.

The name tells everything there is to know: two simple corrections connected by an intervening x-wave.

Almost always, the second correction is a triangle. The break of the triangle is critical for the entire pattern.

Elliott stated clear rules for it: the b-d trendline must break in less than the time it took the e-wave to form.

Any violation of this rule invalidates the triangle. And, the subsequent breakout.

The breakout respects the rule, making it simple to define the terms of this breakout Forex strategy:

- draw the b-d and a-c trendlines

- wait for the price to break the b-d trendline while respecting the time rule

- wait for the price to close below (in a bearish break) or above (in a bullish break) the b-d trendline

- enter at the close

- place the stop loss on the top/bottom of the e-wave

- target 1:3 rr ratio or the measured move – whichever comes first

In this case, the measured move comes earlier than the 1:3 rr ratio.

As a reminder, an rr ratio stands for the risk-reward ratio that expresses the risk taken in relation to the reward targeted.

The higher the ratio, the better, with the currency market rarely offering the opportunity to trade rr ratio higher than 1:3, unless you have a specific trading system that helps you to achieve that.

Conclusion

The examples used in this article are meant to show how to use a breakout Forex strategy.

They reveal clear setups, with steps to take when trading breakouts.

It is interesting to point out that the breakout example using the triangular pattern works similarly with the one involving the Bollinger Bands.

Just add the Bollinger Bands indicator on the USDJPY triangle and you can see it yourselves!

The conclusion is that there’s only one breakout to trade, but many methods to spot it.

Trading a breakout needs:

- an entry point (patience for the market to close)

- stop-loss (previous swing’s high or low)

- target (rr ratio of 1:3 or a pattern’s measured move, whichever comes first)

Because trading is a game of probabilities, even a breakout doesn’t offer a hundred percent chances to land on the right side of the market.

Algorithmic trading is responsible for many spikes in today’s markets, and this is enough for emphasising the need for a stop-loss order.

A risk-reward that makes sense gives room for error.

Using a 1:3 ratio allows the account to break even despite suffering three consecutive losses.

That is if the risk follows a constant proportion.

To sum up, breakouts are part of today’s currency markets.

Many times the markets simply consolidate waiting for a reason to move.

A disciplined trader knows the rules to trade a breakout ahead of it.

When the breakout finally comes, the savvy trader waits for the candlestick to close below or above the relevant levels.

Moreover, a stop-loss must remain in place all the time so to avoid false breaks.

Finally, proper rr ratios help the trading account grow faster while protecting past profits.

After all, this is the ultimate goal of every currency trader.

P.S.

Check out one of my more popular articles on Trend Following HERE or another one HERE