What is The Best Time to Trade Forex

Contents in this article

Best Time to Trade Forex

It is hard to say what the best time to trade FOREX is. There are common beliefs that will be discussed in this article. In the end, the most important factor for successful trading is discipline and following your own rules. Time is just one of the most important elements to consider when deciding on a trade. It should not be taken for granted, but treated with the respect it deserves. This article is about the best time to trade forex!

by: @colibritrader

Introduction-Different Time Sessions

In the world of trading, there are quite a few important factors to pay attention to- time to trade forex is definitely one of them.

As you can see in the image above, trading forex takes time in 3 different major time sessions- Tokyo, London and New York. They will be revealed below. What is important to know is that each one has its own characteristics.

As longer-term traders, they should not really affect us, but if you are a shorter-term trader, you’d better be paying closer attention to them.

Let’s start exploring these time zones by the Tokyo Session first.

Tokyo Session

There are fifteen exchanges around the world trading forex. I am not sure if the Tokyo session is the best time to trade forex. For some traders it could be, but it really depends on the trading strategy.

The active trading hours for the Tokyo trading session are (in GMT):

-

12am- 9am

The Tokyo session is well known to be a more quiet session. Surprises are never absent, but they will be more the exception than the confirmation of the rule.

Based on my experience and conversations with other traders, the best strategies to be utilised for a less volatile trading environment are:

-

scalping

-

range-trading

Scalping is diametrically opposed to the way I trade. I do believe in longer-term trading, since it has proven to be a more reliable way of reading the markets through the years.

If you are scalping during the Tokyo session, you should bear in mind that smaller timeframes must be used. Having said that, I in no way want to advise you to do that, since I am myself staying away from that type of trading.

Tokyo’s trading session might not be the best time to trade for everyone. You should approach this session only if you have a proven trading strategy that works with it.

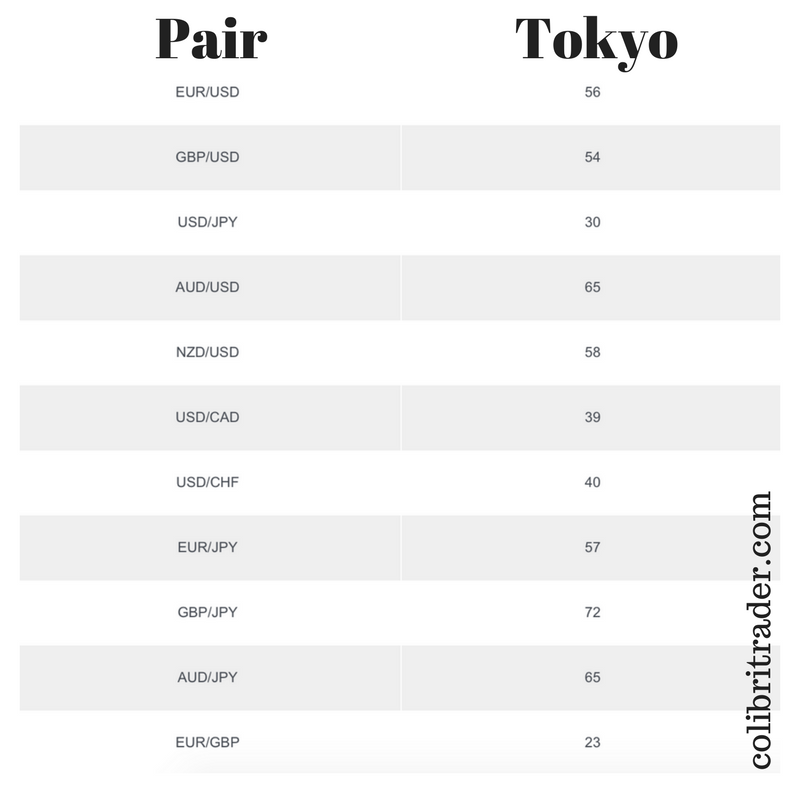

Below, I will give the average number of pips made during the Tokyo session for a few of the most traded FX pairs.

London Session

The next session down the clock is the London trading session. It is perceived by many to be the best time to trade forex.

Is it?

One thing can be agreed with certainty- the London session is VOLATILE!

If you are starting trading just now, you need to be cautious with the London session, especially around the opening times, which is at 8 GMT.

The active trading hours are:

-

8am- 5pm

The usual type of strategies for the London session are breakout strategies. This is not coincidental.

The reason being- the increased volatility due to the large amount of market participants.

Fortunes have been made and lost during the London session.

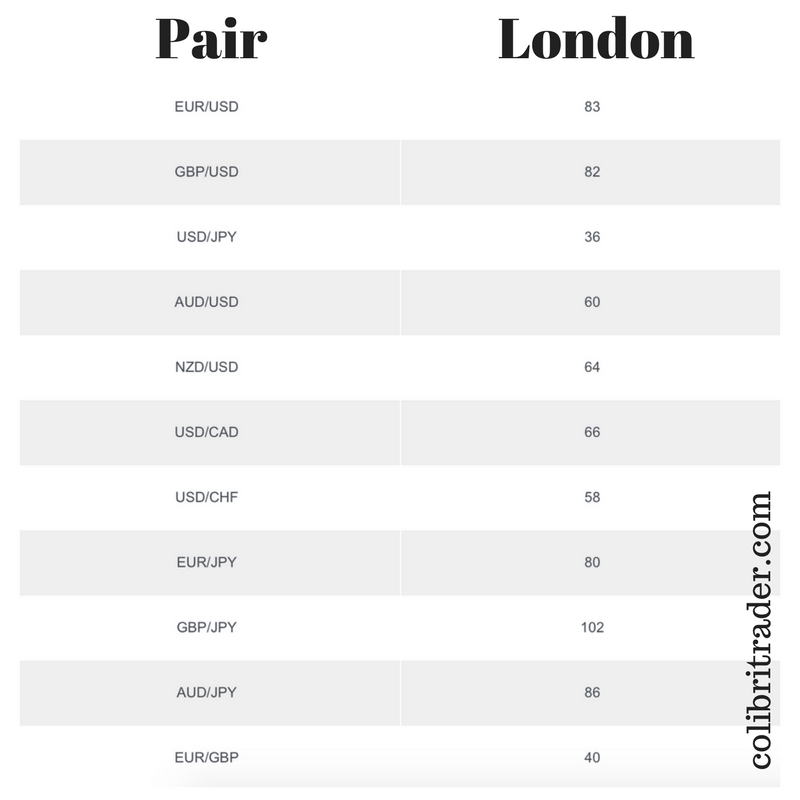

Below, I will give the average number of pips made during the London session for a few of the most traded FX pairs.

New York Session

The New York trading session is probably the second best time to trade Forex. It is also extremely volatile, especially at open. If you are not experienced, you should stay away from the screens when New York opens.

The active trading hours are:

- 13pm- 21pm

The usual type of trading strategies that day traders use during the New York session are reversal strategies. In extreme cases (20% of the time) they use continuation strategies.

Imagine that when London opens, the volatility of the market brings price high or low enough. Traders have already made money in the London session. So, what is left for the US traders if they want to make money and there are no major news?

Reverse the trade.

That is a typical scenario. If the first half of the day is bullish, the second part of the day is bearish (just like in the image above).

Of course, that is not the case every time. In strong bullish/bearish days, you will have a break around lunch time and when the americans “join the party”, the trend will resume.

One final thing is the average number of pips during the New York session. They are given below:

FOREX Trading Overlaps

Another very important factor when thinking about the best times to trade Forex is the trading overlap.

What is a trading overlap?

Trading overlap is the time period between two major trading sessions. In this sense, there are three trading overlaps.

Tokyo-London

The Tokyo-London overlap is probably not the best time to trade Forex. It is a pretty quiet period during which the momentum slowly builds up. Active traders are more attracted to the next overlap.

London-New York

The London-New York overlap is known to be possibly the most turbulent time of the day for traders. That is because traders from the two busiest trading centres start exchanging trades. Definitely not a newbie area and I highly recommend that you try to cut or minimise to a minimum trading around this overlap.

Best Days to Trade FOREX

It is hard to say which days are best to trade Forex. I can certainly say that usually Mondays are not as active as the rest of the week. On Monday, the markets are choosing a direction and it might not be the best time to trade Forex.

From Tuesday onwards is when the majority of reports start coming out and the momentum builds up.

Friday is another day that is typically not favourite amongst day traders. It is when the trading week finishes and a lot of traders are unwinding their trades.

That means that probably the best days to trade Forex are Tuesday, Wednesday and Thursday.

Not every week is the same as the next one, but this is more or less the rule that a lot of traders do follow when considering what is the best time to trade Forex.

Is It Necessary That I Trade During Those Times To Be Profitable?

Absolutely not!

There is nothing more misleading than the conception that you need to trade in a certain time or day to be profitable in trading Forex.

These are just general guidelines that will help you better understand the market structure.

As I am teaching in my trading course, there is nothing more important than self-discipline, trading plan and the right money management skills.

Therefore, the best time to trade Forex is when you feel ready. I have written an exclusive article on why it is important to trade less and take just the best trades.

Summing Up What Are The Best Times To Trade Forex

In the end of the day, it is not so much about the time or the day of the week. The best time to trade Forex is when you are strictly following your trading plan.

Also, the best time to trade Forex is when you are following your trading plan. You can’t go wrong with the right trading tools and the right money management skills.

As traders, it is important to know the general structure and what can be expected at certain times and days of the week. The rest is really up to the experience we gain as traders.

It takes time and routine, but with the right mindset you can achieve anything. You just need to find the right tools first and learn how to utilise them in your favour.

Nothing comes easy, but if you are persistent enough and are willing to learn, you can reach new heights in your trading career and learn what the best time to trade Forex is 🙂

#nevergiveup

p.s. In case you are interested to learn more about the way I trade on a professional level, you can check out my pro trading course HERE. If you have any questions, you can always address them to: admin@colibritrader.com

p.p.s.

If you are interested to learn more about other popular indicators, you can check them out here:

CANDLESTICKS

MONEY MANAGEMENT

TRADING WITH TRIANGLES

CHART PATTERNS

it’s amazing how price moves 24-hours from monday to friday and is formed in the name of “market” which is quiet nowadays as things are done on a push of buttons.

Dear Colibritrader,

Thank you VERY much for your article “What is The Best Time to Trade Forex”.

I think it would be fascinating if you could do the same piece but on the Crypto markets. I think there could be some similarities because the Crypto market is also segregated into Asian, European and American with USA/Aisa making up 70%.

I trade Crypto from South Africa so I trade in the London/European zone, but also trading the European/USA crossover and USA zone. I’d like to also trade Asian zone, because they are a dominant player in the Crypto space, but I need to sleep sometime…

I enjoy all your pieces and read them daily and look forward to more on Crypto and my suggested topic above.

Hello Cornelius,

Thank you for the nice words! I will think about it. Cryptos are already in our daily lives and this could be a good idea. Stay tuned and be always awesome, no matter what you trade 😉

Excellent, this is what I have been looking for.

Thank for the info.

You are welcome. Let me know if any questions