AUDJPY Trading Setup

AUDJPY Trading Setup

by: Colibri Trader

Dear traders,

The trading setup from last time has worked out amazingly well. Oil has made a small retracement back to 47.15 and then dropped down to 45.57, where it is currently trading. Currently, I am not seeing a reason why to take profit. Seems like a lot of sellers entered this trade and crude was down for almost 3% for the day. Now, I will possibly be looking for another opportunity to add to this trade. The ones amongst you who have taken my trading course should know what I mean. Since, this is a pure analysis and not a recommendation to buy/sell, I cannot really advise on more.

AUDJPY Trading Setup

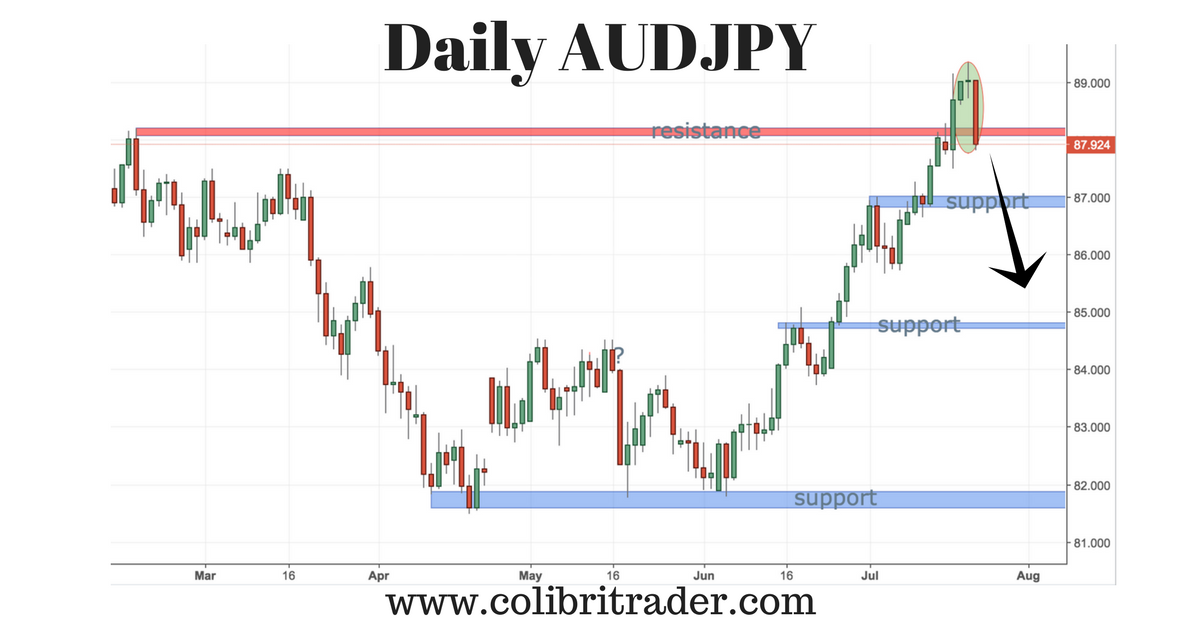

Today’s trading setup is coming from an unconventional place- AUDJPY. I am seeing a rejection of a major resistance area. If you zoom in, you will see that this is a multi-week resistance area. If you change to a weekly chart, you will see that there is a pin bar that formed. This gives further significance to the position and the price action pattern from the daily timeframe. The daily timeframe is actually showing an evening-star pattern (if you want to refresh your candlestick patterns knowledge, check out my article HERE). If I decide to proceed with a trade, I will be looking how price is acting around the area of 88.40. A potential stop could be placed just above the heights of 89.50. I will be looking for price targets as follows: 1) 87.00 2) 85.00 3) 81.50. This is of course if price action is confirming the case for a further decline.

Happy Trading,

Colibri Trader

p.s.

Have you checked my previous article on Moving Averages?

If you want to learn more about my professional trading strategy, you can visit my dedicated page.

are you still looking 88.40 area to enter ?

Yes- still looking. Trading is a game of patience 🙂

I would like to know your thought process and advise on this.

Since 05 June, the trend seems to be up.

The trend line is not broken even after the formation of that evening star.

In fact I had not noticed the formation of evening star on daily TF until I saw your article.

I had only noticed the pin bar on the weekly chart along with the rejection of price at major resistance.

I was thinking of going on SHORT on Monday if :

Price opens below the low of pinbar and pulls back a bit (did not happen).

or price pulls back from the current price on daily TF

After I read your article I changed my idea as I had failed to notice the formation of evening bar on daily TF.

It was really making sense to wait for the pull back (I believe 50% of the big bearish candle).

Unfortunately, it has retraced more than that.

I believe in the current situation, the setup will be invalid or will you still wait to go SHORT.

Hi TS,

Why don’t you consider taking colibritrader’s professional course? one need to understand his professional method so easier to understand what colibri is talking in his posts here.

Best regards,

Harry

Harry…that is in mind as well. I will approach him when I have some money to afford him. In the mean time, I would like to have some sort of knowledge before joining the course so that it becomes easy to understand.

Hi TS,

Unfortunately, I can only do analysis here- otherwise I can be in trouble giving advise :). I am sure you know what I mean. Regarding your thinking- I completely agree. My thinking behind that article was mostly regarding the major resistance area. I have just posted a new article on DAX, where I mention briefly the why and whats of that. So far, I have been out of this trade and am looking at DAX currently. AUDJPY has proven to be tougher than expected. It might be worthwhile reconsidering this pair around the 90- area. Until then, I prefer to concentrate on something more urgent 🙂 Hope that makes sense! Last but not least- it is great having you here sharing your thoughts! Cheers,

Colibri

Thanks for the response again. As this current swing is in uptrend, I believe also this pair will go till 90 area which is next resistance level in weekly chart and from there it may reverse. That area also confluences with some of the fib ratio based upon the daily chart. I will keep watching.

Anyway, I am very happy that I could share my thoughts with you and got the feedback as well.

Your published articles are very informative for a newbie like me. Thank you again.

I am glad I am helpful- that is the point of this website. I am not giving signals, I am trying to make sense of price action and help you understand the basics of it:) it is all about the basics