8 Common Option Trading Strategies

Trading can seem such a mysterious craft.

Have you ever wondered how could traders with radically different personalities, using completely different trading methods, yet all taking home profits?

What’s going on here?

The critical success factor of an investor is finding a trading approach that resonates with all personal intricacies the most.

Options do exactly that – the insane versatility of options trading strategies enables us to tailor the suitable approach for anyone.

Using options, the buyer has the right to buy or sell (“exercise”) an asset at an arranged price within a certain period.

Notice that there’s no obligation to exercise the option for the holder.

Also, keep in mind that the option is a derivative, so you’ll be trading a contract, not an actual underlying asset.

Next, we’ll dive deeper into how options work and look at straightforward options trading strategies.

Contents in this article

Get to know the terminology

Some of the most challenging things about options is getting the hang of terminology.

However, once you grasp the key definitions and trading principles, you’ll be able to get the mechanics of any strategy.

Feel free to scroll back to this section from time to time as you discover options trading strategies later on.

CLICK HERE 👉🏽 To Download The Options Calculator 👈🏽

Key definitions

Here options jargon will become your mother tongue as you go from the very basic concepts to more complex ones.

Call – the options contract, allowing the holder to buy an asset within a period between the purchase and expiration date.

Put – the options contract the holder of which can sell an underlying asset at an arranged price before the agreement expires.

Option price – the fee or the premium that the buyer pays to get the option.

A premium consists of intrinsic value and extrinsic value (more about these below).

Exercise –to realize the right of the option holder to buy or sell an underlying asset.

The strike price (exercise price) – is the asset price that the option holder is entitled to transact at if they decide to exercise the contract.

Expiration date – the last day when the holder can exercise an option.

The writer – is the one who sells the option.

In-the-money – the state of a call option when the strike price is lower than the current price of underlying.

The vice-versa is for a put option: the strike price must be higher than the market price of an underlying asset.

At-the-money – when the strike price equals the market one, an option is at-the-money.

Out-of-the-money – for a call option to be out-of-the-money, the strike is higher than the market price of the underlying.

Similarly, an out-of-the-money put option has a strike price that is lower than the market price of the underlying asset.

Intrinsic value – is the part of the option price; this is the difference between the strike and the underlying’s market price.

Extrinsic value (time value) – here’s another part of the option price; this value depends on the time left until expiration.

Thus, the more time contract buyers have to make a profit, the higher the extrinsic value is.

Open interest – the net value of all not yet exercised or expired options.

Trading strategies

Since you already know the key options terminology, let’s get to the trading strategies.

We’ll start from the most basic approaches and proceed to more complex ones.

A top-down approach… sort of.

Building upon the first several concepts will open new trading strategies suitable for a specific kind of investor.

So, be sure to get the foundational stuff first before moving on to advanced options trading methods.

Here we come 👇🏽

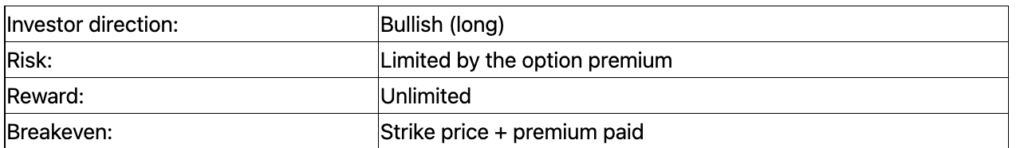

The long call

When you have a bullish market view, expecting the prices to surge, they “go long,” thus buying call options.

This strategy is the most basic way to express a bullish stance.

If the underlying shares or index of an option rise, you will make a profit.

Pretty straightforward, isn’t it?

One of the best sides of such a trading approach is the limited risk and unlimited profit potential.

You only pay a premium – the sole thing at stake.

At the same time, theoretically, the profit can grow as long as the underlying shares or index rally.

The only limit is time until the expiration.

Thus, as options approach the threshold, the time decay kicks in, putting pressure on options value.

Let’s sum it up with the table.

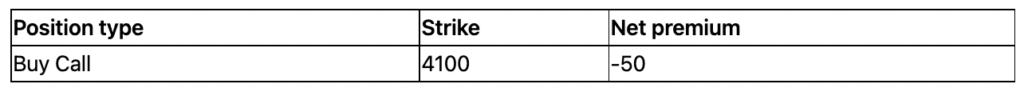

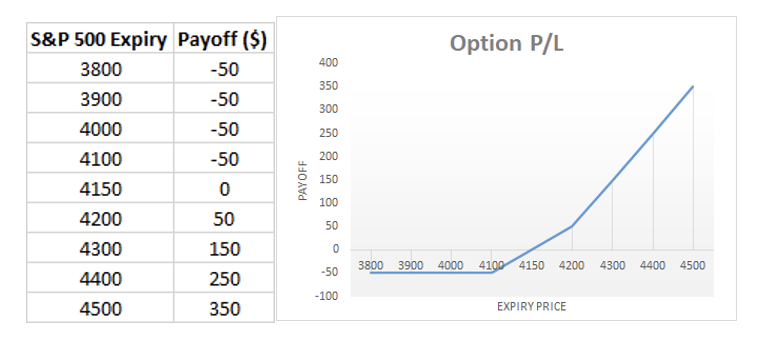

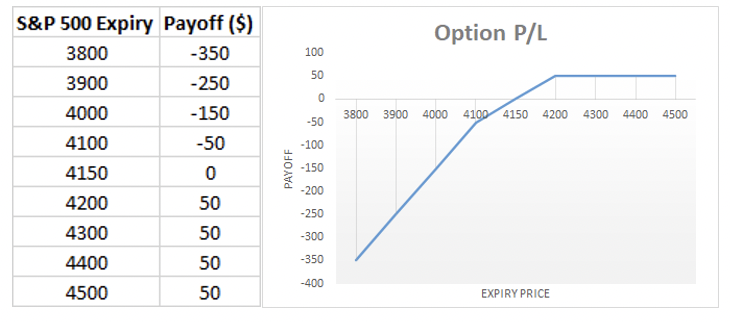

Payoff illustration

Here is a simplistic scenario of how the call option on S&P 500 futures would work.

The S&P is at 4100 now, and you expect the index to go higher.

Therefore, if they buy a call with a strike at 4100, paying the $50 premium, you will profit when S&P rallies above 4150.

The example above shows that the breakeven point is when S&P 500 moves to 4200, while the risk is fixed at $50.

Limit risk for real with options

When we say we can limit risk, we mean it.

Why such a big deal?

For example, when buying an underlying stock, there’s no absolute guarantee that the risk is limited by a stop order.

Stop order only means that you’ll automatically sell at an available market price.

What if there aren’t any guys that want to buy from you anywhere close to your planned exit?

Oops!

Investors like buying options of a company that’s expected to report good earnings.

You know what happens when earnings drive the market – shares often gap in either direction.

In January, Netflix reported great earnings, but if you owned the actual stock, it’d hurt losing 21% overnight from the stock price.

Remember, likewise, the stock price could gap up, so there’s a point in being involved through options.

By buying calls before the release, you’re still risking only the premium paid, unlike stockholders.

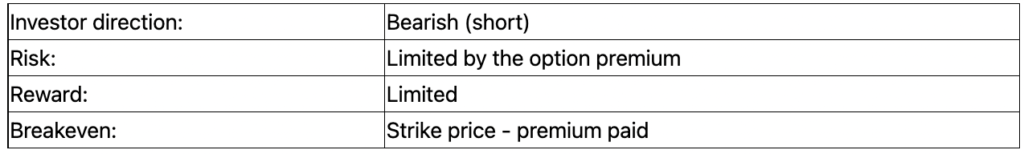

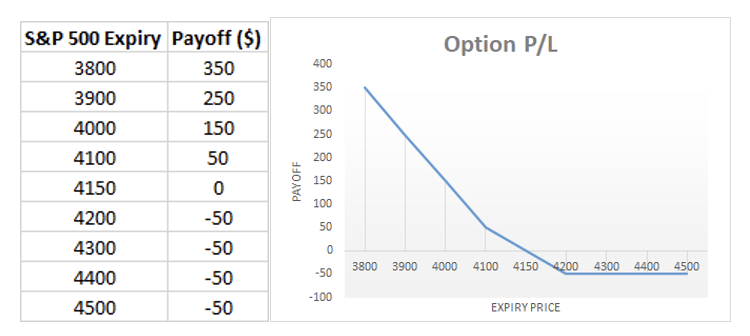

The long put

Going long on put options is a bearish bet on the price of underlying.

In this case, the investor expects the asset to decline.

A put option enables the holder to sell the stock or index (to the writer) at a pre-arranged price.

So, if the instrument falls down, an investor will profit.

At the same time, if the asset price grows, the risk is limited to the amount of premium paid.

The profit potential is essentially limited as the asset move threshold is zero.

Here’s the summary.

Payoff illustration

Below is the P/L payoff schedule for the long put.

With the stock index currently at 4200, the investor has a bearish view of the market.

If the investor buys a put when S&P is at 4200, the option will turn into in-the-money below 4150.

The trade becomes loss-free when the stock index falls below 4200 in the above image.

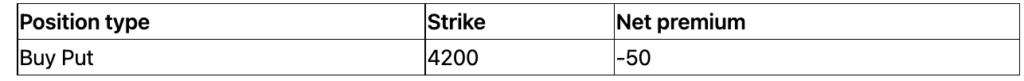

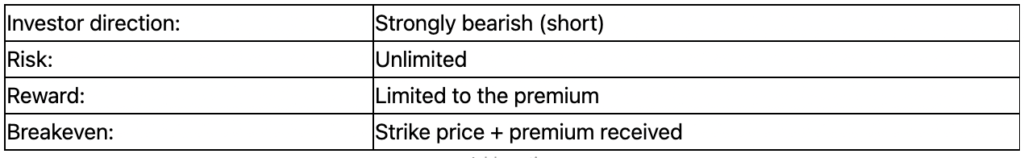

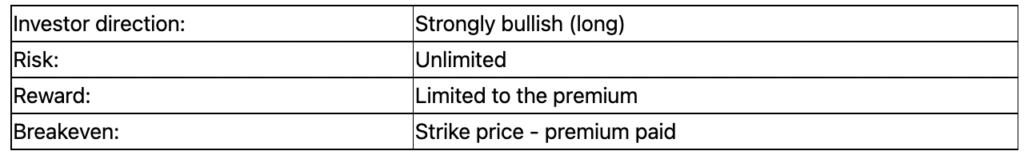

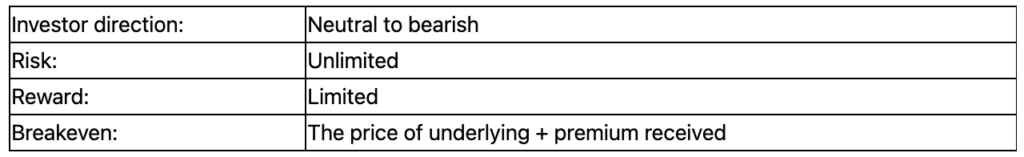

The short call

Suppose an investor is strongly bearish on the stock index, considering there won’t be any significant spikes in the near future.

It can be reasonable to “write” (sell) a call, gaining a modest profit immediately as a premium.

However, there’s always a risk of large losses should the underlying go higher far above the strike price.

The only way to protect the position against unlimited losses is hedging, for instance, buying calls.

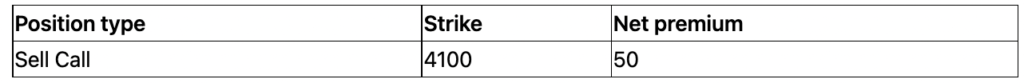

Payoff illustration

Suppose S&P is at 4100 now, and you expect a sharp decline from here.

The sale of a call option with a strike at 4100 will make you $50 in premium from a call buyer.

You’ll end up in profits if the stock index remains below 4150.

The illustration above shows that the trade is at breakeven when the market reaches 4150.

Keep in mind, whatever deep decline you manage to catch, your profits are capped at 50.

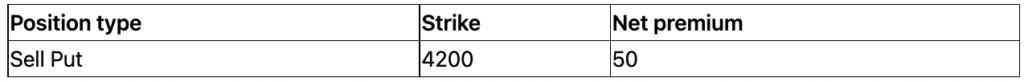

The short put

If you think the market is in a strong uptrend and a correction is still far, write puts.

In this way, you let some contrarians try out shorting the market while you receive your sure thing – the premium.

The worst would be a long-lasting correction when it’s still a while till your sold put expires.

So, as you might guess, similarly to shorting calls, the risk is theoretically unlimited.

All in all, here’s the summary.

However, there’s a little nuance about stock index uptrends.

Food for thought: designed for growth

You see, the sole purpose of a stock index’s existence is to increase in value.

Statistically, corrections don’t go beyond a certain point.

For instance, since The World War II, the average decline of the S&P 500 has been 13.7%.

Corrections (from peak to trough) average six months to form and four months to recover.

Here is some food for thought or potential high win rate ideas 😲 :

a) Write puts that last over six months – for the really patient ones.

b) Sell puts with several months till expiration if the correction lasted at least six months.

c) Short puts when the stock index breaks all-time highs.

Of course, you should do some backtesting using historical stock market prices to design a winning strategy you’re comfortable with.

Moreover, although based on the historical data, don’t forget that high odds are still just odds, so be very careful!

Make sure you have a plan of how to limit risks when things go far out of normal.

“How about hedging”, you would ask?

In general, the strategy is only good as a supplementary one.

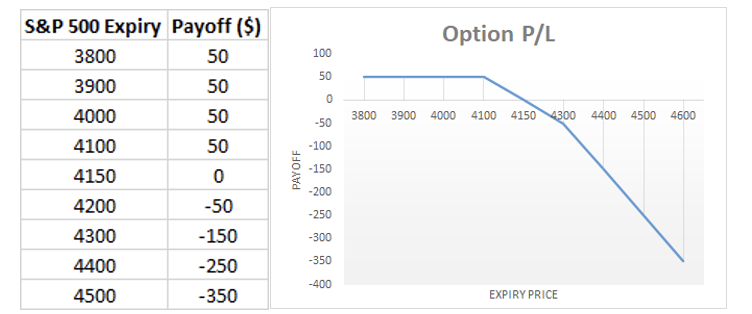

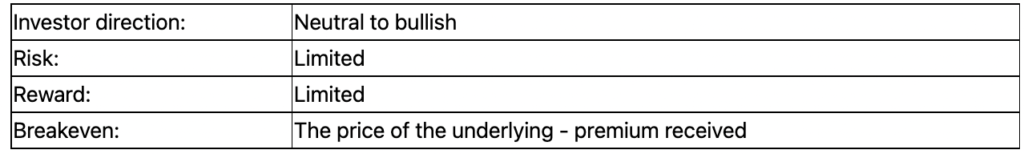

Payoff illustration

The instrument is trading at 4200, and you’re confident the market is going higher.

If you sell S&P with a strike at 4200, there’s an opportunity to profit, assuming the market stays above 4150.

The above example shows that once S&P falls below 4150, you’re exposed to unlimited risk.

The profit potential is still fixed at 50, though.

The covered call option writing

The strategy allows a medium to a long-term bullish investor to bet on the weakness of an asset in the near term.

Here the investor already owns an index or stock and then sells (writes) a call option on the holding.

In this way, the investor receives a premium immediately.

The profit of the underlying increases as its price grows.

Once the underlying reaches the strike price, the profits are capped.

The reason why the profit growth stops is the losses from the option, offsetting any gains from underlying asset appreciation.

Even if the market is just drifting sideways, an investor can still generate income with this strategy.

Your ultimate risk is the price paid for the underlying.

Give a go writing covered calls for a penny stock?

Who knows😊?

Finally, let’s make an overview.

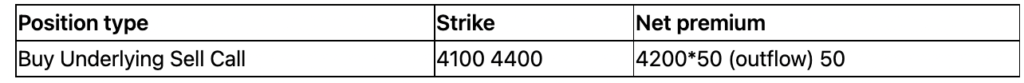

Payoff illustration

The S&P is trading at 4300, while an investor is holding one lot of index futures from 4200.

We start the strategy after selling a call with a strike at 4400, getting a 50 premium.

The idea is that the investor doesn’t expect the futures to go above 4400; otherwise, the profits from the underlying are capped.

The above chart shows that the breakeven is reached when S&P prints 4150, while the maximum reward is 250.

Writing a covered call exposes an investor to unlimited risk.

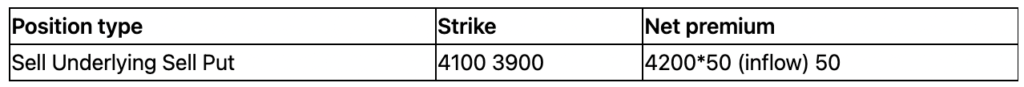

The covered put option writing

Like in selling covered calls, writing covered puts enables an investor to express a neutral market view.

However, in the case of puts, one expects the market to eventually decline in the medium to long-term.

First, an investor shorts a stock index and then writes a put on it, receiving a premium.

The risk exposure from put is “covered” by the short position in underlying.

The profit is locked as long as the stock index stays below the strike price 🤑

After the underlying moves above the strike price and a premium is received, the loss accrues.

The risk here is not capped.

Pro Tip: The stock price can climb indefinitely, accumulating losses on the short position.

So, if you believe the stock price doesn’t have time to land on strike until expiration, you better close that short!

Here are the strategy’s properties.

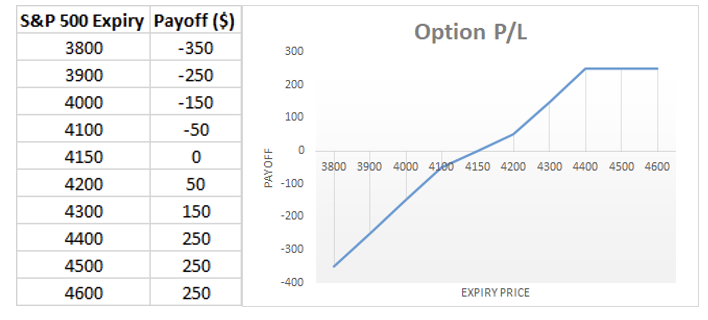

Payoff illustration

The stock index is trading at 4000, with an investor holding a one-lot short position in underlying, initiated at 4100.

We execute a covered put strategy by selling a put option with a strike at 3900, receiving a premium.

Here we don’t expect the stock index to go above 3900.

From the illustration above, we see that the breakeven happens at 4150.

The profit potential is limited to 250 [(adjacent sell call strike price – underlying buy price + received premium) * lot size]

Unlike in covered calls, the risk here is unlimited.

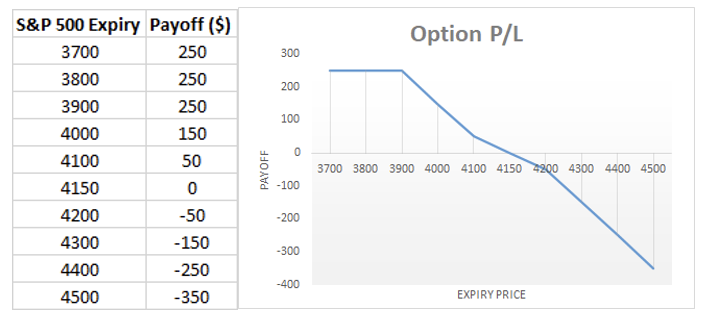

Long straddle

Imagine there’s an event that often causes wild market moves.

Can you take advantage of such volatility without any idea about the direction?

A long straddle strategy makes it possible.

As premiums are the only risks the buyer of the option takes, why not bet on both directions?

Yes, the premiums might be pricey, but the reward is potentially unlimited.

Well, unless you trade long straddle in a penny stock, the reports of which justified that “penny” status😊.

Overall, as long as the profits from that volatility spike can cover premium costs, an investor will profit.

Let’s sum it up 👇🏽

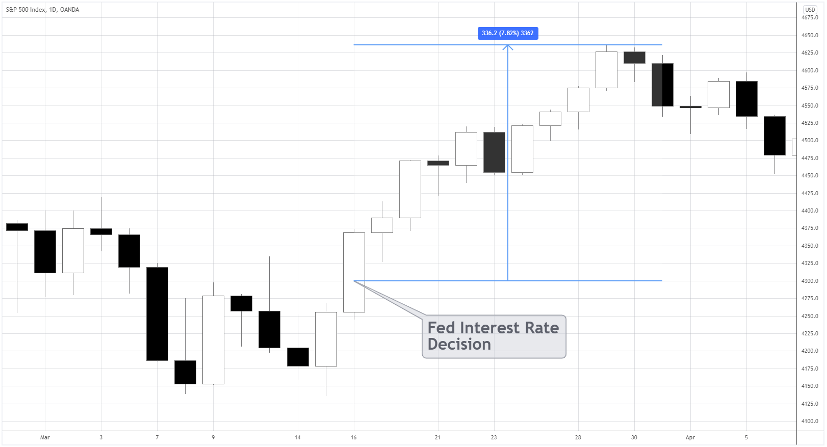

Food for thought: working example

If the long straddle strategy resonates with you, look for events that consistently cause volatility.

Any “sure thing”?

The Fed rate decision is a good example of such.

You can build the long straddle position not long before the event in S&P 500, for instance.

Look what happened in a little over a week after the Fed spoke out.

The index surged almost 8%, not bad.

You can also look for highly volatile individual stocks.

The chart below shows what happened to shares of Tesla after the event.

The EV maker surged over 41%!

And don’t mind that the shares of a tech company soar on rate hike.

Pro Tip: When trading long straddle, your focus should be on the very fact or possibility of volatility, not the logic behind it.

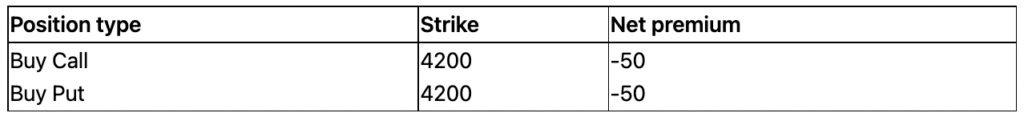

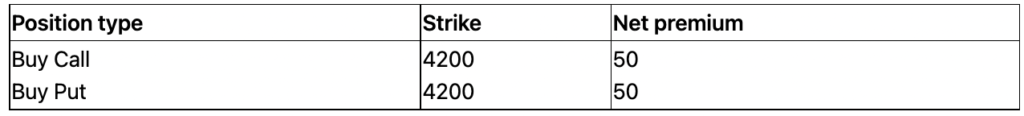

Payoff illustration

With S&P at 4200, we create a long straddle by buying a call and the put option with a strike at 4200.

Assuming the premiums are equal (they can vary in the live market), we’d pay 100 in total for both premiums.

The example above shows that we’ll be at breakeven if the stock index reaches 4100 or 4300.

The maximum risk is limited to 100 (lot size * premium).

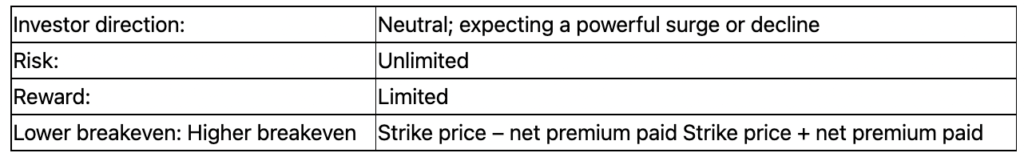

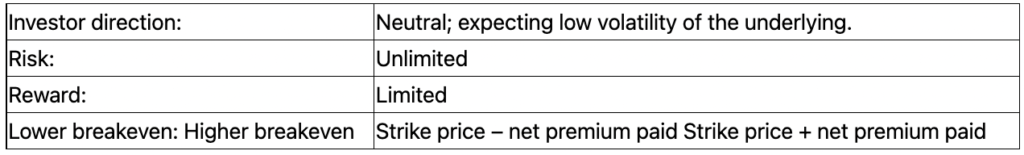

Short straddle

Ok, be careful with this one.

Here we have an opposite of a long straddle, exposing an investor to the unlimited risks in either direction.

As you probably guessed, the point is selling a call and a put, receiving premiums from both.

Two options should be of the same maturity and strike price.

If the underlying isn’t going anywhere, you’ll keep your premiums as buyers won’t exercise worthless options.

On the other hand, if the underlying keeps going up or down, an investor may see losses grow until the option’s expiration.

Check out the summary below.

Food for thought: what shares like standing still?

Complacency aside, we never know if shares will be volatile or not.

Even if there’s nothing going on, the human factor is always present.

Some traders with deep pockets may simply mix up an order and turn the market into chaos.

Consider the Japanese fat finger case in 2014.

Some stocks are trading in a way that’s bound to be ranging, regardless of a broad market.

In February, TD Bank acquired First Horizon (NYSE: FHN), a regional bank in the US.

Usually, the bought company’s stock soars and remains in a tight range until it’s delisted.

That’s what happened to FHN; check out the chart below.

The narrow 6.35% range of the stock is very conducive for the short straddle approach.

After the buyout, it usually takes quite a while until shareholders vote for the deal and regulators do clearing.

So, shares will still change hands, and options traders can profit from it.

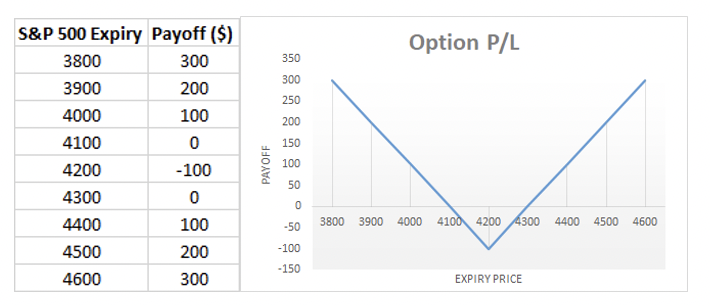

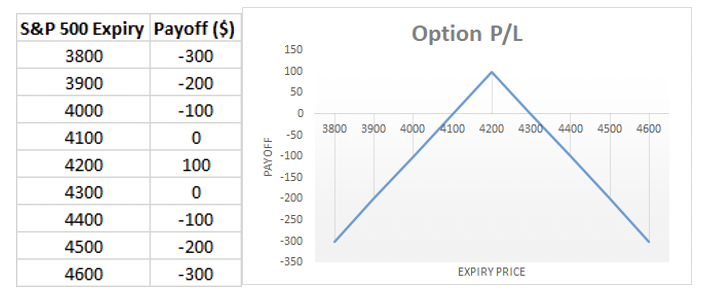

Payoff illustration

When the instrument is trading at 4200, we sell call and put at the strike 4200.

For two sold options will get two premiums totalling 100.

The table above shows the reward is limited to 100.

The position will be at the breakeven if the asset ends up at 4100 or 4300.

How many strategies are there in options trading?

Options promote flexibility in adjusting the risk exposure to the market outlook.

Thus, the more kinds of market context, the more options trading strategies people come up with.

Fun Fact: Over 400 strategies can be applied in options.

That’s a lot!

It may sound overwhelming, but the point is to find what fits you, not try to master hundreds of them.

What is the safest options strategy?

Some say writing covered calls is the safest one.

However, it’s not so “safe,” risking the whole worth of the underlying shares.

What if the safest means the most controllable?

What can we control in trading?

Risks!

Therefore, strategies with limited risk are the safest.

What is the most common trading strategy?

Trading options can get pretty complex, as there are so many possible combinations of options and underlying.

In terms of how many people are using it, probably simple buying of calls or puts are the most common ones.

Which option strategy is most profitable?

The profitability of any strategy largely depends on a trader unless you use a robot.

For example, if you’re really good at finding inflection points in shares, you’ll make good money with a long straddle strategy.

So, the most profitable strategy will be the one that resonates with your personal understanding of the market and helping to stay in sync.

Profitable options trading is so much about the self-discovery!

How many options traders are successful?

Most traders only employ basic strategies (not something like long straddle).

According to John Foley, CEO of Options AI, “Everybody in the business knows that if you’re only buying out-the-money calls, then you’re likely going to lose money over time, “

There is also a common belief that option writers have a higher success rate.

The truth lies somewhere in the middle – the strategies that involve buying and writing options may have a higher success rate.

Traders who employ more complex strategies usually know what they’re doing, thus stacking odds in their favor.

So, what percentage of options traders are profitable then?

Just like in any field, the successful ones are a minority, typically around 10%.

Can you become a millionaire trading the options?

That will depend on your skill and the initial capital.

If you start off with, say, $10000, making a million means you need to show a 10000% return.

Pretty tough, isn’t it?

Usually, a chance to make such a return is extremely low, so it’s a losing game in the long run.

Another thing is if your capital is $500000, you’d only need to double it to become a millionaire.

Making a 30-50% annual return doesn’t sound crazy.

Play with numbers; check your inventory of time, money, and skill to weigh your odds.

Can you trade options with the $100?

The short answer is yes.

Expect $100 to be enough for a few wrong bets.

If your first couple of trades are wrong, you’re out.

Also, commissions will be particularly burdensome each time you place a trade

Is options trading better than trading with stocks?

One of the biggest advantages of options is the limited risk – protection from shares gapping in your face.

On the volatility front, options also win, often providing a more favourable risk:reward ratios compared to stocks.

The time decay is a downside as you can’t hold options for as long as the move lasts without losing value.

How about shares?

Trading shares offers better liquidity, lower fees, and more instruments to choose from. You should assess your trading needs to find out what will work better for you.

Summing It All Up

In the end, you can see that there are as many options trading strategies as there are options traders.

It is hard to say which ones work better than others, since it really depends on your own preferences and trading needs.

The aim of this article was to familiarise you with 8 of the most common ones and and give you an quick introduction into this subject.

I hope that is all clear now.

Happy Trading,

Colibri Trader

P.S.

Have you read my article on 👉🏽 The Most Essential Day Trading Strategies?

P.P.S.

Did you read my recent article on some of the 👉🏽 Most Profitable Futures Trading Strategies?