5 Crucial Position Sizing Lessons to Manage Risk and Maximize Returns Like a Pro

Position sizing is one of the most important, yet often overlooked, elements of a successful trading and investing strategy. Simply put, position sizing determines how much capital to allocate to any given trade or investment.

Master the critical lessons around tactical position sizing and you unlock the door to maximizing upside while minimizing downside risk.

Set your positions too small and returns suffer from a lack of conviction. Size them too big and you invite the twin devils of emotional trading and account blow-ups.

Get it just right, however, through robust risk management frameworks, and you set the stage for sustainable outperformance no matter the asset class or strategy.

Implement these five indispensable position sizing lessons to trade and invest like the pros:

Contents in this article

- Lesson 1: Know Your Personal Risk Tolerance

- Lesson 2: Respect the 1-2% Rule for Position Sizing

- Lesson 3: Factor in Confidence Levels and Market Volatility

- Lesson 4: Avoid Emotionally Charged “Double Down” Traps

- Lesson 5: Continuously Experiment and Adapt Strategies

- Start Investing and Trading With Precision

Lesson 1: Know Your Personal Risk Tolerance

Honestly assessing your willingness and ability to stomach losses is the foundation for determining the appropriate position size.

Those new to investing often underestimate the psychological impact of drawdowns on decision-making, leading to reckless oversizing.

Perform introductory quizzes and track reactions to early losses to calibrate your risk tolerance, which can shift over time as experience builds psychological resilience.

Getting this baseline right lets you size positions to balance potential profits against the known ability to ride out interim declines.

Lesson 2: Respect the 1-2% Rule for Position Sizing

The 1-2% rule guides risking no more than 1-2% of your total capital on any single trade.

This seemingly small allocation per position powerfully protects against emotional trading in the face of losses and contains overall portfolio swings.

Over decades this framework allows compounding to work its magic while ensuring no single play can devastate the portfolio.

Violations of this rule devastate accounts rapidly during inevitable strings of losses. Adhere strictly when starting out.

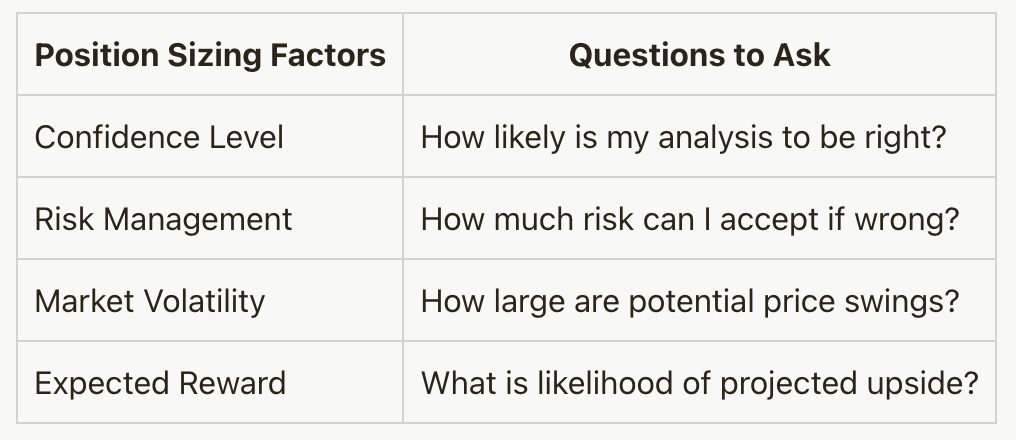

Lesson 3: Factor in Confidence Levels and Market Volatility

The probability of your analysis being correct factors heavily into proper position sizing. The higher your confidence in a trade, the more conviction placed behind it through position size. Ensure excellent reward relative to risk.

Likewise, incorporate measures of market volatility and asset variability when deciding allocation. More potential price fluctuation means smaller sizing to avoid excessive downswing exposure.

Lesson 4: Avoid Emotionally Charged “Double Down” Traps

As losses hit, the urge intensifies to aggressively double position size to recoup sunk capital. Psychologically this compounds frustration while exponentially increasing portfolio risk.

By contrast, pro investors and traders dispassionately stick to plans, accept small losses, and live to fight another day.

Rashly throwing good money after bad frequently turns small missteps into major drawdowns.

Lesson 5: Continuously Experiment and Adapt Strategies

Like any skill, dialing in the right position sizing approach takes practice through trial and error.

Be data-driven – track quantitative metrics around wins, losses, and drawdowns at different position size levels.

Where oversizing exacerbates losses, undersizing hampers returns.

Find the sweet spot through experimentation then keep adapting as market conditions and your talents evolve.

Getting sizing right unlocks trading mastery.

Start Investing and Trading With Precision

From assessing risk tolerance to methodically inputting key variables, tactical position sizing separates professionals from amateurs.

Prioritizing these lessons minimizes unnecessary losses, maximizes gains, manages psychological pitfalls, and sets the foundation for continual growth.

For more insights and training resources on developing a robust and sustainable trading business leveraging position sizing fundamentals, see our recommended materials.

Then shift your mindset and outcomes through world-class education!