5 Fundamental Trading Strategies Every Trader Should Consider

Fundamental trading strategies have a mystical aura for currency traders.

No one knows precisely what it is nor how to define fundamental analysis.

Yet, fundamental trading strategies do exist.

And, to the surprise of many traders (mainly technical ones), they add value to a trade.

Fundamental analysis alone works to some extent.

Technical analysis alone suffers from similar limitations.

However, together, the two areas of market analysis give a complete market picture.

They offer the benefit of gaining the most from a market move.

>>Get 5 Swing Trading Strategies PDF<<

Contents in this article

- What is Fundamental Analysis?

- Fundamental Trading Strategies to Consider

- Fundamental Strategy #1: The Carry Trade in the 21st Century – One of the Most Important Fundamental Trading Strategies

- News Trading – How to Make the Most of It

- Fundamental Strategy #2: Trading the EURUSD During the NFP Week

- Fundamental Strategy #3: Trading Major Geopolitical Events

- Safe-Haven Currencies

- Brexit

- Fundamental Strategy #4: U.S. Presidential Election

- Fundamental Strategy #5: Interpreting Monetary Policy

- Conclusion

In this article, we intend to show some fundamental trading strategies to consider.

That is done just for educational purposes.

As you all probably know, I am a price action trader, using price action strategies.

Many times, traders wonder why the market doesn’t move. I mean, the price reaches support and should bounce.

Right?

Or, price hits resistance and should “fall like a rock”!

Why is it still consolidating around, doing nothing then?

Fundamental vs. Technical Analysis

Fundamental analysis is the answer.

Technical analysis shows the potential future direction. But fundamental analysis gives the reason why the market moves.

Or, the impulse- the kick.

Otherwise, it’ll merely consolidate.

Therefore, fundamental strategies consider the sum of all aspects that might influence trading.

That is, aspects other than technical.

The fundamental trading strategies presented in this article aren’t something new for the versatile trader.

However, many retail traders tend to ignore the importance of fundamental trading.

And that’s a critical mistake when trading in the 21st century.

Among other things, this article treats:

- What is fundamental analysis?

- How to follow and use great fundamental trading strategies

- What is the carry trade and how it evolved in time?

But above all, the intention here is to use examples to clarify things.

Because the fundamental area is so vast, there’s plenty of aspects to discuss, starting with monetary policy and ending with geopolitical and macro events.

What is Fundamental Analysis?

Before going deeper into fundamental trading strategies used when trading the currency market, we need to define fundamental analysis.

In short, it contains everything else that’s not technical.

In other words:

- Economic news

- Released based on a predetermined schedule, they offer a glimpse into the business cycle of an economy at a certain point in time. The economic indicators here are leading or lagging. And, in some cases, coincidental.

- News in general

- Any news that has the potential to move prices (below are given a few examples)

- A central banker’s opinion in a newspaper

- G7 meeting news

- OPEC meeting news

- Any news that has the potential to move prices (below are given a few examples)

- Macroeconomic events

- Changes in monetary policy in important jurisdictions

- Presidential elections

- Trump’s election in the United States

- Macron’s election in France

- Referendums

- Brexit vote

- Natural phenomena

- Hurricanes

- Storms

- Floods

- Extreme weather conditions

- Tsunamis

Obviously, some of the events part of fundamental analysis occur regularly.

That is, the economic indicators (i.e., economic news released regularly) have a predetermined calendar.

Known in advance, the economic calendar allows traders to prepare for the release properly.

Hence, it allows traders to build fundamental trading strategies to make the most of these releases.

But some other components of fundamental analysis take everyone by surprise.

Impossible to forecast, they affect the markets in every way.

Natural phenomena, extreme weather conditions, wars, etc., are only some examples that fit into this category.

Feel free to add all other events that come to mind on top of the things mentioned above.

That’s still part of fundamental analysis.

Therefore, you have an idea now why it is difficult to put a strict definition to fundamental analysis.

And, the most appropriate one is that it represents the sum of everything that happens in the world, except technical analysis.

Fundamental Trading Strategies

The subject of fundamental analysis is so vast that it is difficult to pick fundamental trading strategies that work all of the time.

However, the following examples are relevant for what to expect in similar circumstances.

And, by interpreting how the market reacts, we form an educated guess about how they will react.

The Carry Trade in the 21st Century – One of the Most Important Fundamental Trading Strategies

The carry trade is one of the oldest fundamental trading strategies in currency trading.

While the definition on the Internet may sound confusing, the idea behind this strategy is quite simple.

Judging by its definition, carry trade means borrowing in a low-interest rate currency and using the proceeds to invest in a different asset.

For instance, borrowing in JPY and converting them to USD to buy U.S. stocks.

This translates into a higher USDJPY and higher U.S. stocks, a trade known as risk-on (in fact, is just a classic example of a carry trade).

In currency trading, the simple way to interpret a carry trade is to consider the interest rate differential of the two currencies.

Therefore, the one with the higher interest rate is more attractive.

Depending on the direction of the trade (long or short), the pair “pays” a positive or negative swap.

Or, the carry trade is positive for the currency pair with a higher interest rate and if it’s traded in the same direction.

For a long time, the AUDUSD pair symbolised the carry trade.

The RBA (Reserve Bank of Australia) kept the interest rates much higher than the Fed in the States, fuelled by a decades-long expansion.

As such, traders invested on the long side on AUDUSD, and every night they earned the “carry” on the pair. The higher the volume, the bigger the carry.

Nowadays, with negative interest rates affecting the currency market, things changed a bit.

But the principle remains the same.

Good carry trade examples are:

- Long USDCHF

- Short EURUSD

- Short GBPUSD

Carry trades change based on how interest rates change.

For a swing trader, the carry matters as it can easily add a few percentages to a trade.

News Trading – How to Make the Most of It

Perhaps the most known of all fundamental trading strategies is “news trading”.

That is, to buy or sell a currency pair based on your interpretation of economic news.

Again, it needs more clarification.

One of the major volatility sources for the currency market, economic news, dictate price levels most of the times.

Traders look at the economic calendar and interpret the actual compared with the forecast values.

On a better than expected outcome, that’s bullish for the currency.

But news trading has a major problem.

That is, the trading algorithms react much faster than manual traders can do.

Hence, the info or news to trade on must be carefully filtered.

The perfect example comes from the ECB and the Euro.

Back in 2013, the Eurozone HICP (inflation) came out.

It took everyone by surprise, as it came well below expectations.

The EURUSD 4h chart from above speaks for itself.

The market took it as bearish, and it dropped like a rock.

Lower inflation translated into a high probability that the ECB will cut rates at the next meeting.

Following a one-week long horizontal consolidation, the ECB meeting was due.

Note that all market participants know in advance when the central banks meet. After all, this is the economic calendar’s purpose.

The ECB meeting came out and they delivered a rate cut.

In an instant, the EURUSD pair (and all other Euro pairs) moved significantly, over two-hundred pips.

Is this news trading?

Yes, it is.

And, it is based on interpreting the news, preparing in advance, and waiting for the outcome.

Such fundamental trading strategies might work if you are really good at reading events and outcomes.

There is just one more thing to consider and that is that sometimes news are already priced in before the news hits the wires.

Trading the EURUSD During the NFP Week

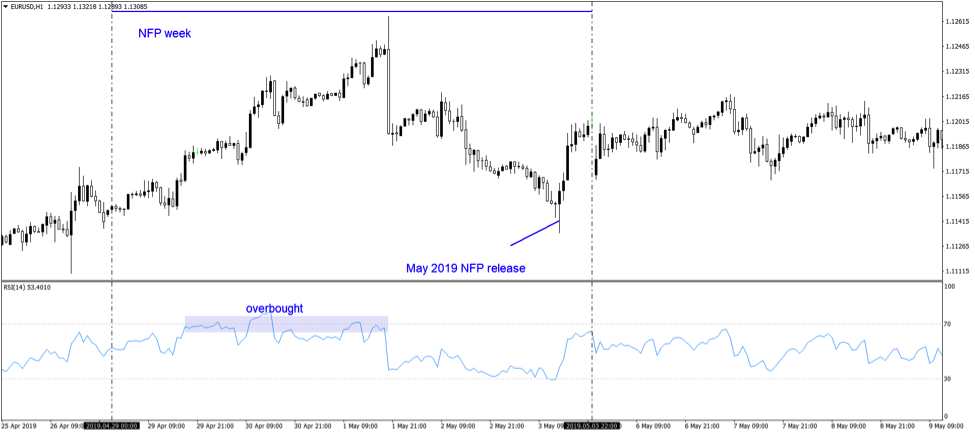

One of the most interesting fundamental trading strategies involves the EURUSD and the NFP.

For those who do not know, the NFP or Non-Farm Payrolls is a critical economic release out of the United States.

It always comes out on the first Friday of each month.

It makes room for special trading conditions.

No one wants to take a chance ahead of the NFP release.

Hence, ranges most likely dominate.

As a trader, if you know that the chances are that the market will range, that’s a tremendous advantage.

Range trading works best with oscillators.

Hence, the fundamental analysis tells us the market most likely will range until the NFP release.

Combining that with a technical indicator gives great setups on currency pairs like the EURUSD.

Despite being based on a technical indicator, such a strategy is driven by fundamentals.

After all, no one would look for ranges if it wasn’t for the NFP week in the first place.

Trading Major Geopolitical Events

Fear sells.

You probably know this by now as all news networks profit from fear. Newspapers too.

The currency market is the first to react to fear.

Due to its high volatility, it’ll move in a blink of an eye.

Some currencies have a direct reaction to negative, geopolitical events that happen in the world.

For this reason, no matter the technical setup, or the regular economic analysis, investors will take refuge into the safe-haven currencies.

Safe-Haven Currencies

To start with, the U.S. Dollar is the world’s reserve currency.

When everything goes wrong in the world, traders look for refuge into the American Dollar.

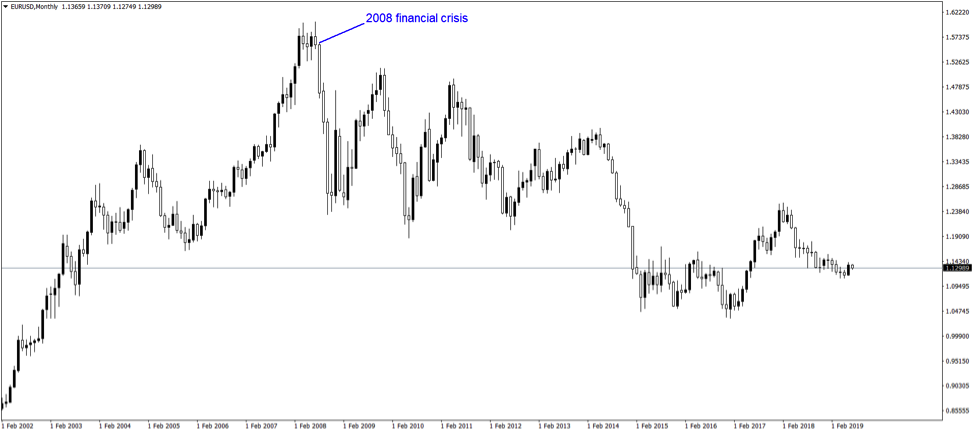

The best example comes from the 2008 financial crisis.

The Fed slashed the interest rate on the USD to almost zero, in a proactive move.

Other central banks lagged the Fed’s move. As such, from a pure interest rate differential, the USD should have depreciated.

Instead, investors realised something else.

If the Fed, the world’s most powerful central bank, slashed the rates to zero, the other central banks will follow suit.

Therefore, not only that the USD didn’t depreciate, but it was the start of a strong trend higher, easy to spot now on the EURUSD pair, for instance.

Other safe-haven currencies appreciate too in times of uncertainty. Such currencies are the JPY and the CHF.

Fundamental trading strategies must always consider the safe-haven reaction as, when fear strikes, nothing else matters but protecting the capital by all means.

Brexit

2016 is a great example to illustrate the importance of fundamental trading strategies in the Forex market.

The Brexit referendum that took place that year is very relevant.

The market, in general, simply didn’t move.

Everyone just waited for the referendum’s result.

In the currency market, this translates in large consolidation areas.

No break turns out to be for real, as the market reverses to the equilibrium point.

U.S. Presidential Election

As it turned out, even the Brexit vote and outcome were not enough to move the market.

While the pound suffered a gigantic move, in the months to follow it quickly reversed most of it.

The EURUSD chart above shows that.

Another important macro-event was due later in 2018: the U.S. Presidential Election.

Following a tight race, Trump won.

What happened took everyone by surprise.

Pre-election market reactions indicated that the stock market in the United States would tank on a Trump win.

And, move higher on a Hillary move.

For months, every time a new poll came out, the fundamental trading strategies to use depended on the poll’s interpretation.

If Trump tanked in surveys, the DJIA moved higher, triggering a move higher in the USDJPY pair too. (Check here for the relationship between DJIA and USDJPY)

However, as the chart above shows, by the time the election night went by, the market realised the implications of a Trump win.

All the promises in the campaign were suddenly interpreted, as the win became a reality, and not merely a possibility.

Thus, DJIA exploded higher.

It triggered a USD move higher, visible here on the EURUSD chart.

The EURUSD chart perfectly summarises the importance of macro-events in currency trading.

The U.S. Presidential Election marked the end of two-and-a-half years of consolidation.

In fact, it marked the end of a limiting triangle with levels that are still important.

For those trading gaps, the Macron gap (President Macron’s election in France) is still open.

Trading to close the gap is nothing but a reaction to a fundamental event. In this case, a macro one.

Interpreting Monetary Policy

Monetary policy dictates fundamental trading strategies.

It isn’t by chance that we left this topic for the end of the list.

Success in trading is not possible without a clear understanding of what monetary policy is and how it relates to currency trading.

Changes in monetary policy create tectonic shifts in the currency market.

One of the most critical tasks of a trader is to interpret the next step in the monetary policy of a central bank.

The earlier, the better.

We used a relevant example in this article.

The EURUSD drop after the lower than expected inflation triggered a massive move lower that took weeks.

The earlier the interpretation and positioning, the better.

What were the implications?

The ECB has the mandate to keep price stability.

It means, to keep inflation below but close to the two percent level.

As inflation dropped, traders immediately interpreted the release through the ECB eyes.

What does it mean for the monetary policy in the Eurozone?

Obviously, they sold the Euro on expectations that the ECB will alter the monetary policy.

It happened just that, so the ones that sold the Euro earlier profited the most.

This is just to illustrate how fundamental trading strategies derive from interpreting monetary policy.

Conclusion

Almost all retail traders prefer technical analysis.

In a way, it is normal.

Technical analysis has the great advantage that it offers clear levels.

For a technical trader, the entry, stop-loss, and take-profit have nothing to do with fundamental analysis.

However, fundamental trading strategies come to complete technical analysis.

In fact, any market analysis is just incomplete without the fundamental aspect.

We can even associate the trading style with technical or fundamental analysis.

For instance, novice or rookie retail traders use mostly technical analysis.

Swing traders and investors have a deeper understanding of the markets.

Such traders understand that the market doesn’t move all the time.

They have more patience and wait for the market to come to specific levels. Trading takes place on bigger timeframes, and time for a trade is not an issue.

Moreover, fundamental analysis complements technical analysis.

Hence, the derived targets do not have only a technical aspect, but a fundamental one too.

To sum up, the fundamental trading strategies presented here work more often than not.

The only thing is for traders to keep an open mind to what fundamental analysis is.

What matters today for the market may mean nothing tomorrow.

So always keep an eye and be flexible enough to reflect the constantly changing market environment.

For this reason, a currency trader is an informed trader.

And, an informed trader uses fundamental trading strategies to make the most out of every market environment.

Thanks again for all the knowledge, great mentor.

Please, how does Lower timeframe patterns affect the market?

can you be more specifix, please?

Please, the Lower timeframes M1 up to M30.

I have learnt that the Higher timeframe Weekly and Monthly also direct the market’s movement.

Actually, I do not know how to relate Timeframes in order to trade profitably.

Please I need your help

Thanks

Timeframes are coming as part of a trading strategy. You need a trading plan and a way to see how you can implement it with the help of the timeframes. Usually the lower the timeframe, the riskier the trading strategy. Higher timeframes and lower trading frequencies are more suitable for beginner traders. You can email me for more information on that

I think it’s best to combine technical analysis with fundamentals to increase the chance of success

So we look for overextended stock prices (tech analysis) and calculate the fair value (fundamentals), if both show the stock is undervalued and ready to bounce back bullish, I can sell At the Money Put Spreads to maximise my Return on Capital

Hi Tony, that is one way to look at the market and the market is as varied as the market participants in it. But you have made a very good point here! Thanks for your feedback