5 Day Trading Strategies That Work

Day trading strategies are one of the most popular ways of trading for the past 10 years.

However, does it mean day trading strategies are better than, for example, swing trading strategies?

According to most sources, day trading is even considered gambling, and traders that employ such strategies – speculators.

If day trading is popular, is it also a good trading method?

Bonus Material: Download The Day Trading Guide

It is not for everyone and that is why we need to dive into details that will help clarify how to shape your trading.

Day Trading became more of a thing since new asset classes such as cryptocurrencies and technologies came to surface.

It has become times easier to gain access to trading than ever before.

There are thousands of day trading strategies that could be categorised into several classes, but what is important is to pick the one that matches your personality.

Before my pick of the 5 day trading strategies, beginners should read key takeaways first.

If you are an experienced trader, just skip to the next section.

Contents in this article

- What is Day Trading?

- How to Be a Day Trader?

- Day Trading Apps and Platforms

- What Are the Best Day Trading Brokers

- Types of Day Trading Strategies

- Day Trading Strategy#1: M5 Trend Following MACD

- Day Trading Strategy #2: M30 RSI Divergence and Stochastics

- Day Trading Strategy#3: M1 Crypto Scalping Day Trading Strategy

- Day Trading Strategy #4: Donchain Channel Day Trading Strategy

- Day Trading Strategy #5: M15 Waddah Attar Explosion strategy

- Summing It Up

What is Day Trading?

Simply said, day trading involves strategies where trade positions are not held longer than one day.

Now, this opens a lot of space to contemplate where do day traders get an edge in trading.

Just because day traders like to get in and out of positions frequently it does not serve you any great value.

That is why we need to discuss strategies that have proven to work.

At the end of the day, every trading strategy works only up to the amount of testing we put into it.

As we try out new things we find out some strategies, indicators or trading rules that work better, and even better when combined with other tools.

Be prepared that whatever you read about any day trading strategy may not work for you or it may still need more refinement.

How to Be a Day Trader?

It comes down to your preferences, needs, lifestyle, and psychology first.

If you are not very new to trading, you probably know most traders lose money in the long-term.

Most of them failed not because of a bad day trading strategy, but because they lacked the right mindset.

Preferences matching

1) Do you like intensive action?

2) Do you have a day job?

3) Do you have a lot of free time?

Answer those questions before proceeding any further.

No day trading strategy will work if there is something that conflicts with your preferences.

Ask yourself can you keep up your attention with all of your obligations away from trading.

Some traders feel depleted after a day trading session.

Understand that every time you think about a new trading session, your brain will resist because it is far from enjoyable.

So keep day trading enjoyable by matching what you can achieve with what your personality enjoys.

Switch to a higher timeframe and see if a slower pace works better for you.

In this way trading will not be a chore and you will be interested to improve your strategy, get consistent and better results.

Psychology

As with every trader, psychology is one of the most important pillars of trading.

Day trading psychology does not differ much from other trading methods, however, I need to point out some observations.

Since day trading is packed with action, it is better suited for people with a lower patience threshold.

Remember: No trading strategy will work if you cannot wait for the trade signal.

NB: If you keep moving your Stop Loss just because you refuse to accept a losing trade, the strategy will not work.

Younger traders are, of course, less patient, want to get rich quickly, and usually rush to day trading.

Despite your intelligence, these psychological mistakes are unavoidable for beginners.

Make these mistakes on a demo account.

Take your time and make sure your day trading strategy works on more than 100 trades and more than on one asset class.

Risk Management

Another pillar of successful trading is to learn to manage how much you can lose at all times.

Day trading strategies are not an exception here- you will need great money management rules.

However, day trading has to cope with additional risk factors other strategies might not have.

One of them is “trading sessions”, for example.

Depending on the asset you pick for trading, you will need to know when that asset is more volatile and when it typically ranges during the day.

Your Risk management also has to cope with the news events on that day.

These are company reports, and even tweets (Elon Musk + Tweeter = Crypto alert)

Since day trading strategies also have shorter time horizons, an adequate stop loss will likely be closer to your entry than for other strategies.

This means you will need a broker with tight spreads so you do not end up with winning trades that do not make much profit.

Day Trading Apps and Platforms

To get any of the day trading strategies executed properly, we would need the right tools.

Today, we have so many platforms developed, from proprietary ones to the popular and widespread MetaTrader platform.

Day trading requires fast execution, especially if you choose to go for high-frequency trading on lower timeframes.

While the execution time may depend on the broker, it can also depend on the platform used.

Be sure to check that your day trading strategy is appropriate for mobile app trading if you are often on the move (although I do not recommend that).

TradingView and TrendSpider are also a popular platform choice amongst day traders, similar to the Metatrader 4 and 5.

Reason being is because they have wide support for automated trading robots and scripts, mostly made for Day Traders.

Customization on these platforms also allows you to make many different day trading strategies tailor-made to your preferences.

Now, not all brokers offer these platforms or integrate feedback, which brings us to the next question.

What Are the Best Day Trading Brokers

The best broker for Day Trading should have tight spreads, good execution time, and support the above platforms.

Additionally, you want almost no slippage, and be sure that the connection does not drop out.

If you are an advanced trader, you may also seek a broker that supports API and VPN for your automated day trading strategy.

If you are into cryptocurrencies, you might be interested in 24/7 quoting so you can day trade crypto during the weekends.

Brokers will offer different leverage levels and usually day traders prefer to have more than 1:5 leverage.

Some day trading strategies involving quick trading require a larger trade size to provide for better results.

This is why leverage is important, yet these day trading strategies are not adequate for beginners because of the risk involved.

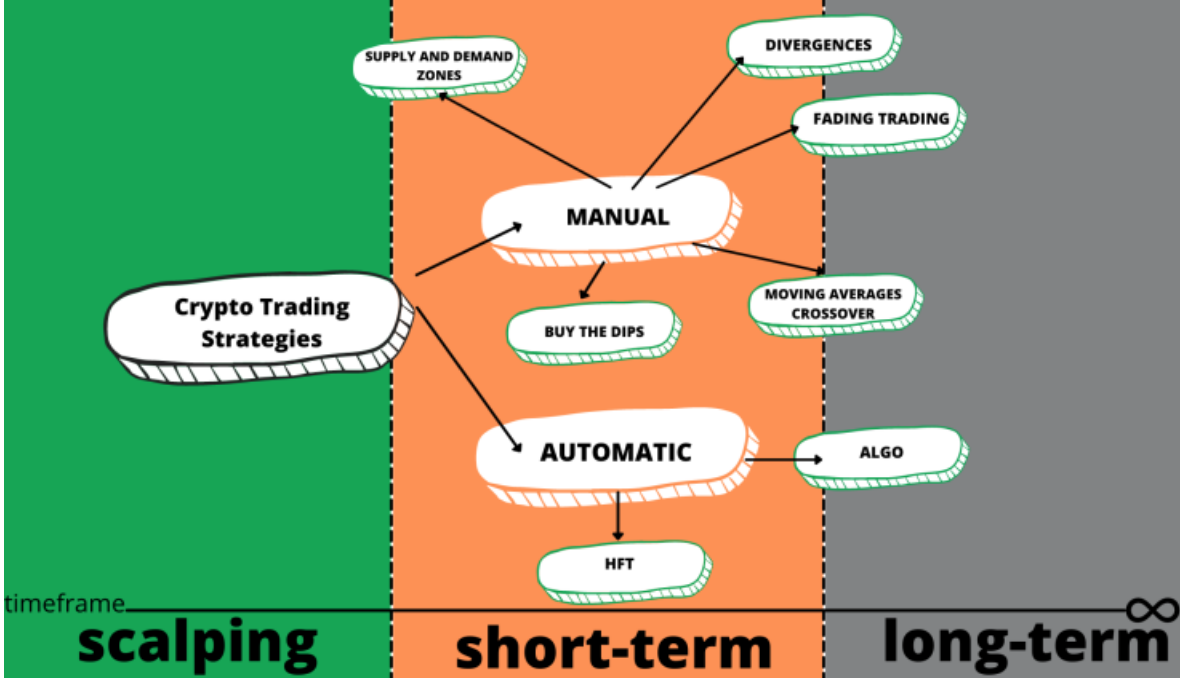

Types of Day Trading Strategies

Let’s now go over some of the types of day trading strategies out there.

I will start with one of the most widespread ones.

Scalping

This is the most popular day trading strategy, often automated and rarely set on higher than the H1 timeframe.

Scalping can be used in trending and ranging markets, quickly getting in and out once there is a small hint the momentum is dying out.

Scalping therefore often employs a momentum indicator that registers sudden shift as an entry signal.

When you look at the chart it looks like peaks and throughs are scalped during the trade.

The idea of day scalping strategies is to capitalise on the strong momentum as the price is unlikely to resist it unless there is decreased liquidity in the market.

When the market is trending, scalpers usually take only trades in the trend direction that gives them stronger pushing momentum.

Day Trading Price Action

Price action patterns and levels identification is where your skill to read the charts comes into play.

This method applies to any asset and any timeframe, so it can be used for day trading as well.

However, Price Action requires more reliable points that are not overruled often because of the noise.

If you are trying to make a strategy into lower timeframes, avoid M1 and M5 timeframes.

Unless your Pirce Action is based on multiple candle information, the signals will be more reliable on M15 and higher.

Many price action day traders consider the higher timeframes before confirming with an intra-day trading entry.

Therefore, you will find fewer signals with this method than with any other day trading strategy.

Intra-day range trading

This is a kind of channel day trading when there are no established trends on a higher timeframe.

Day traders like to employ this strategy when they face low volatility or volume in the market.

To find out if a market is ranging they use volume or volatility indicators, yet some just read the candlesticks’ highs and lows.

Certain day traders enjoy ranging periods in between trading sessions.

This environment has smooth-ranging movement without spikes that could trigger unwanted outcomes.

It is unlikely a trend will emerge when there are no active big investors or banks that create momentum.

I call it a “channel strategy” because trades are placed inside high and low fields of Supply and Demand.

With a setup like this, we expect the price to go back into the channel to capture profits.

Day traders could use oscillators that show oversold and overbought ranges, channel type indicators, or trendlines too.

Trend following

Most traders will switch to trend-following strategies when range action is over.

Day Trading strategies use this method during evident activity on the market.

Trends could be caused by a news event or a fundamental long-term driver on a higher timeframe.

If we look at the indexes for the past two years, we can see a huge, consistent bullish trend.

This is a great time to employ a day trend-following strategy that generates profits as long the trend persists.

Day traders using those trading strategies usually wait for the volume or volatility to pick up and then jump in.

One of the basic rules of this strategy is not to trade against the prevailing trend.

Simply because the odds will be against you.

News trading

This is a popular day trading strategy that is rarely used on higher timeframes than H1.

The goal is to capture high energy moves caused by an important key economic report.

Traders are very careful about how long they leave a trade open after the news and apply conservative risk rules.

Since you do not apply Supply and Demand when trading the news, it is more important how you will place your pending trades.

Most day traders set pending orders before the event and cancel them after 15 minutes if they are not triggered.

This is a risky but lucrative trading method for those looking for fast profits.

Beginner day traders should not be interested in news trading before exploring other methods.

Before further ado, let’s jump straight into the trading strategies.

I. M5 Trend Following MACD Day Trading Strategy

This day trading strategy is action-packed using just 3 simple and common indicators.

It is a pullback entry type strategy that follows the main trend.

The anchor timeframe is 5 Minutes but we will use two EMAs that gauge the higher trend.

We set up the trade direction rules based on EMAs, while the MACD provides signals.

Remember: If you tinker with the rules of a strategy, the strategy might not work as expected.

Work on your discipline to follow the strategy to the letter.

Now, let’s break down what you need first for the strategy setup.

Strategy elements

You can use this strategy on any asset, for example, EURUSD, and set it to the M5 timeframe.

Add the first EMA, set it to 600 periods, this will be our main trend gauge.

Add the second EMA set on 150 periods, another trend gauge that we will use for the EMA cross rule.

The final ingredient is the MACD on default settings (12, 26, close, 6).

Strategy rules

Whenever the faster EMA (150) crosses the slower EMA (600) we trade only in the direction of the EMA cross.

So, when fast EMA crosses the slow EMA up, we only enter a long trade and vice versa.

The second rule is about the MACD trade entry signals.

To have an entry, MACD lines have to be below the zero histogram line.

When the MACD lines are below and then cross up, we have a signal to buy, obeying the EMA rules.

Similarly, when EMA cross signals the trend is now bearish, we wait for both of the MACD lines to go above the histogram.

Then we enter a trade on the first MACD lines cross.

The MACD tells us when there is a good pullback entry in an already established trend so we have better odds and better outcomes.

Risk management

Notice that some signals are generated when the market is calm, even though a major trend is still going.

Such signals should have adequate Stop Loss and Take Profit levels.

None of the trades have the same SL and TP distance.

For this particular strategy, it is advised to put your SL at the previous wick’s low for longs.

For shorts, find the previous wick’s high and set your SL at that level.

You can use various risk/reward ratios or use trailing stops for exits.

You can even try partial closing on the first TP and leave the other half uncapped that ends with the trailing stop.

Start with 1.5 times the risk as your TP level and see what works out best for you.

Pros and Cons

The strategy is simple but effective, easy to set up and follow.

However, this is an indicator-based strategy, it does not follow the market structure very well.

You will notice losers can stack up when the trend is shifting but EMAs do not reflect that immediately.

Also, MACD can generate false signals when the market calms down.

Traders that employ this simple day trading strategy add MACD divergence rules for more reliability.

This, however, significantly decreases entry signal frequency and makes it more difficult for a trader to find them.

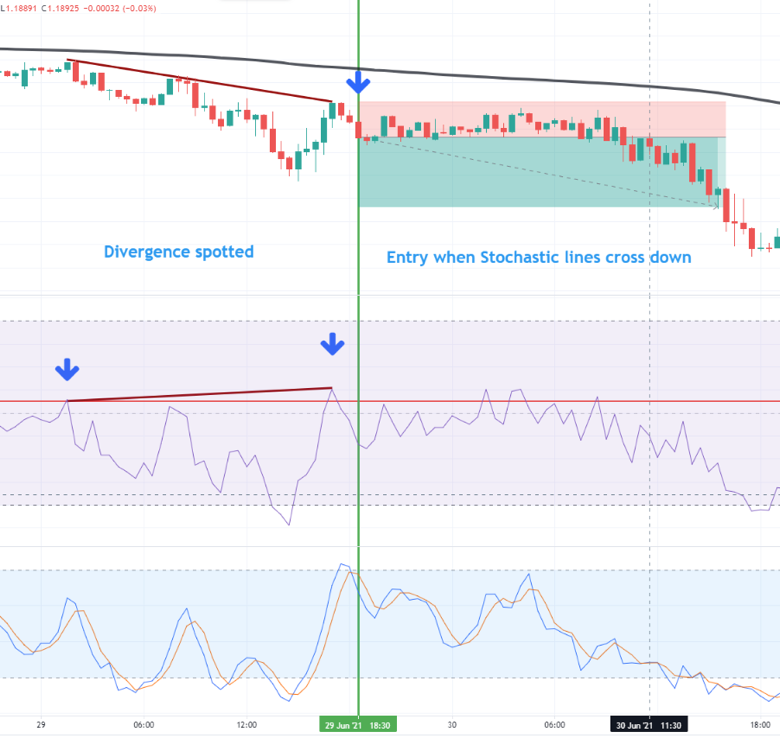

II. M30 RSI Divergence and Stochastics Day Trading Strategy

Trading on the 30-minute timeframe might get you into the following day if you have a very good trade running.

It is more important to follow your risk management structure than staying intra-day.

This day trading strategy uses hidden divergences on the RSI that are further confirmed with a Stochastic line cross.

We do not look at the RSI overbought or oversold levels.

We will only look for divergences.

This means you will need to understand how to spot a divergence using price action points and extremes on the RSI.

I will show you one way how to easily spot hidden divergences.

On average, this strategy will generate about 15 signals per month on any given single chart.

Strategy elements

Add a 200 EMA for main trend gauging, RSI, and Stochastic indicator.

RSI and Stochastic settings are by default.

For easy divergence spotting, use a trading platform that enables drawing horizontal lines.

TradingView has RSI divergence indicators ready if you want a quick solution.

Strategy rules

The 200 EMA will tell us when the trend structure is intact and when it is broken.

When the price is above the 200 EMA enter only long trades and when it is below enter only in short trades.

RSI divergence generates a trade entry signal and the Stochastic confirms it.

After you spot a divergence on the RSI, enter only when the Stochastic lines cross in the direction of the trend.

To spot a divergence, always draw a new horizontal line on the RSI low and seek any new cross below that line.

When that new RSI lower low below horizontal line matches a higher low on the chart, that is a bullish divergence.

The next step is to wait for the Stochastic lines to cross up and that is your buy signal.

For short trades, you will do the opposite, seek RSI higher highs that match lower high on the chart.

You will just need to pay attention to the RSI/horizontal line cross and confirm the divergence with the price chart.

Risk management

Day traders rarely risk more than 2% per trade on any given strategy.

For this particular strategy, place your long position SL at the latest swing low or the bottom of the lowest candlewick.

For a short position, do the opposite and this will enable you to follow the trend structure.

Take Profit placement should be 2 times the Stop Loss for a total of 1:2 R/R ratio.

Using this risk management configuration means that you will need to lose more than 2 times in a row to lose money.

Use scaling out and trailing stops at your discretion.

Pros and Cons

Day Trading strategies like this one are very simple once you get the hang of divergences.

What’s more, this strategy has an above 50% win rate using the 1:2 RR.

The drawback is that you will probably want to have more signals per day.

A solution could be to use this strategy on several asset classes (but only after you have back tested it).

Similar to the previous one, this day trading strategy works best in an already established trend.

Losers can accumulate when the price jumps around the 200 EMA without a defined direction.

However, the net gain on this strategy looks promising, especially when it is perfected with more rules or indicators.

III. M1 Crypto Scalping Day Trading Strategy

If you are ready for action I present you one of the most intense Day Trading strategies, tested and working (making money).

Although the strategy is intended for major cryptocurrencies, you can try it out on other assets.

The major reason cryptocurrencies are good for this strategy is the momentum and the low trading cost with some crypto platforms.

Therefore, make sure you have a low-cost broker or exchange or the spreads and commissions will eat up the gains.

If you are a beginner, avoid this strategy.

It will require a lot of attention, quick thinking, fingers, and robot-like behavior.

Strategy elements

Add Williams %R at the default, 14 periods, it will be our main confirmation indicator.

Add 200 EMA as a trend direction filter.

Finally, we will use a price action pattern – Engulfing bearish and bullish candles as our trade entry signal.

You can find them manually or you can also use an indicator for automatic engulfing recognition.

Strategy rules

Similar to the rest of the Day trading strategies, trading with the trend remains our main style.

When the price is above 200 EMA only enters long and when it is below only short.

Engulfing candle pattern emerges quite often and on the M1 timeframe, you will have tons of signals.

Logically, trade only bullish engulfing patterns on the up trends and vice versa.

Once you have a pattern confirmed after the candle closes, look at the Willimas %R.

This indicator line must be above -50 for bullish signal confirmation and below -50 for bearish.

Risk Management

Considering this is a very high-paced strategy with many signals, you do not need to risk more than 0.5% per trade.

Put your Stop Loss just below the entry candle for a long trade and above for short.

Aim for 2 times SL level as your target Take Profit for a 1:2 Risk/reward ratio.

You can experiment with the exit strategy, use the Williams %R for partial closing or you can just use fixed 100% Take Profit as your exit.

Pros and Cons

Picking the right broker or cryptocurrency exchange is very important.

M1 Crypto Scalping Day Trading Strategy is very active and could be fun to some, but practice at least 1000 trades on a demo account.

The good news is you will need just a few days to forward test this high-frequency scalping on a single chart.

Liquidity on the M1 timeframe could be an issue, if you see gaps and still candles, avoid trading this strategy.

Trading costs play a major factor in your account end line, however, you might try if it works for you on the M5 timeframe.

The worst enemy of this strategy is a dead market, so you can consider additional ranging market filters.

IV. Donchain Channel Day Trading Strategy

It is interesting how just one indicator can be enough to be profitable if used in conjunction with the right money management skills.

However, I will leave it up to your trading practice to master this strategy.

Donchain channels mimics price action breakout strategies out from a pullback.

According to testing, adding just a simple EMA as a trend filter further improves the results.

Since this strategy only uses two indicators, it is beginner-friendly.

Strategy elements

Add the Donchain Channel indicator using the default setting of 21 periods.

Add 200 EMA as a trend direction filter, but you can choose a trend indicator of your choice.

Strategy rules

You can use a 30-minute timeframe, however, try other timeframes and see which one works best in your case.

Enter only long trades when the price is above the 200 EMA and only short when it is below.

Donchain Channel will tell where to place your stop loss and when to enter into a trade.

For an uptrend signal, the price needs to push the bottom Donchain channel band lower, and then break the upper Donchain band on a higher high.

For a short signal, the price needs to push the top band first and then enter at the candle that makes a lower low at the bottom band.

Price action is what confirms that pullback and breakout entry signal

Risk Management

Great thing is that Doncahin bands tell you where your stop loss should be.

Simply just place your SL at the lower band for long trades and the top band for shorts.

Aim for a 1.5 R/R ratio.

In other words, your take profit will be 1.5 times away from your entry.

Experiment with trailing stops or partial closing since this day trading strategy is also following the trend.

Pros and Cons

The Donchain indicator is good for beginners who want to learn market structure, pullbacks, and breakouts.

If you experience ranging price action, you can notice Donchain Channel bands can also serve as support and resistance levels.

The channel will be noticeably narrower in ranging conditions, so you can even choose to avoid trading.

While the win rate of this Doncahin Day Trading strategy is above 50% using 1 to 1.5 R/R might not give the best odds to some traders.

V. M15 Waddah Attar Explosion Day Trading Strategy

Waddah Attar is a composite indicator that shows when there is enough energy in a trend.

Additionally, it shows the direction of the move and when that move is losing momentum.

Therefore, we are talking about the trend-following day trading strategy that filters ranging markets.

To increase the reliability, I have added one more element that has proven to be a reliable trend confirmator.

Strategy elements

Waddah Attar Explosion is not as popular indicator as the RSI or MACD but it is effective in finding trends that last.

In the MetaTrader platform this indicator is not included by default, so you need to add them manually.

TradingView has a few variants, but stay within default settings and pick the first one on the list.

Also, add the Kijun-Sen moving average.

This is an element from the well-known Ichimoku Cloud indicator that we will use for trend confirmation.

Use default settings for this one too at 26 periods.

Strategy rules

When the price is above the Kijun-Sen, we only go long and we only short when below it.

Waddah Attar has red/green bars for bearish and bullish environment, and also shows a line.

Enter a trade only if the bar is above the line.

This signals us there is enough momentum.

You can also use this BB line for trade exits since it signals that trend momentum is gone.

Risk management

Waddah Attar will filter the signals from a ranging market but it does not tell where you can put Stop Loss.

You can place your stop loss at the candle bottom once you get a trade signal and aim for 2 times take profit target.

Now, you can use fixed stop loss and take profit like this but since Waddah Attar also tells you when the trend is about to stop, we can use this for exits.

Close half of your position at take profit and leave the other half running as long the momentum is present.

Also, move your stop loss to breakeven (entry price level) once your TP is hit.

Now your remaining half will never be a losing trade.

Once you see a bar on Waddah Attar below the line, exit the remaining half because the trend has lost momentum.

This way you can enjoy much larger trends with no need to cap your profits.

Pros and Cons

A day trading strategy that follows the trend like this will tell you when to trade, when to exit, and when the market is ranging.

It also offers a scaling-out position management technique that maximises profits on longer trends.

Traders might need a bit of practice for scaling out.

On MetaTrader 4 you will have to open two identical positions for each half.

Even with the ranging filter and Kijun-Sen, you might still get false breakouts, so prepare for the worst and expect the best.

Day Trading Strategies: Summing It Up

As with any other style, day trading is a way to trade the markets that captures a unique trading philosophy.

Being able to capture profits daily is very tempting.

Unfortunately, when you are using a day trading approach, you will need to pay attention to the stats.

And stats are saying that more than 95% of traders day trading are losing in the long-term.

In this article we have seen that losing is part of any trading strategy and even more so of day trading.

Therefore, rigorous money management techniques are necessary.

Hard-solid trading discipline is essential for reaching your goals as a day trader.

The 5 day trading strategies presented in this article are just a small part of what is out there.

I might boldly conclude that there are as many day trading strategies as there are day traders.

Trade reasonably and good luck with your future endeavours.

Happy trading,

Colibri Trader