10 Price Action Trading Tips That Will Help You Become Better Traders

Contents in this article

- What is price action trading and why it does make you a better trader

- Is price action trading better than other types of trading?

- Support and Resistance

- Candlesticks

- No Indicators

- Timeframes

- Does it matter which instrument i will trade?

- Determine The Trend

- Do I trade ranges?

- Patience pays back

- Role of Money Management

- Summary

10 Price Action Trading Tips That Will Help You Become Better Traders

What is price action trading and why it does make you a better trader

Price action trading is a type of trading that allows traders to observe and study the current market. This in turn, allows you to anticipate the market trend and make certain assumptions/decisions based on the current (and actual) price movements.

Price action trading is the most pure type of trading that eliminates all noise.

It does not anticipate, it reads the market.

Price action is great!

Bonus Material: CLICK HERE TO DOWNLOAD FREE CANDLESTICKS E-BOOK

Is price action trading better than other types of trading?

Hard to say.

It is really difficult to say if one type of trading is better than another. What matters is which type of trading fits your personality.

Another important element of trading is money management. What matters is even not that much the trading system, but the way you use it.

Profitable traders will agree with me.

One thing that cannot be denied is that price action trading is probably the easiest to initially grasp and probably the most difficult to master.

In this sense it is like comparing snowboarding with skiing. I was asked once what is easier- learning how to ski or snowboard. My answer is that skiing is easier to learn, but takes much longer to master. Same holds true for price action trading.

Support and Resistance

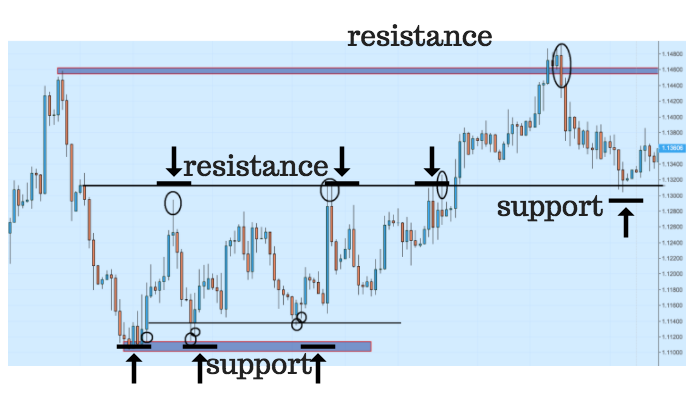

So what is support and resistance.

Support is the level at which demand is so strong, so it does not allow price to go lower.

Resistance is the level at which buyers are hesitant to continue buying, because price has gone too far and is too expensive.

In my previous articles I have given a very detailed account of what support and resistance are and how they can be used in conjunction with price action. If you want to learn in details how I see support and resistance visit my article HERE. Otherwise, have a look at the short example below:

This is an example of a EURUSD 4 hour chart. As you can see from the image above we have one support, one resistance and one support-turned-into resistance area in the middle of the chart.

In this instance above, we have 3 clearly defined levels which act as indication for price action traders. Usually, when support and resistance are used, traders are using candlesticks for confirmation. Let’s have a look at what candlesticks are and how they are used in conjunction with price action.

Candlesticks

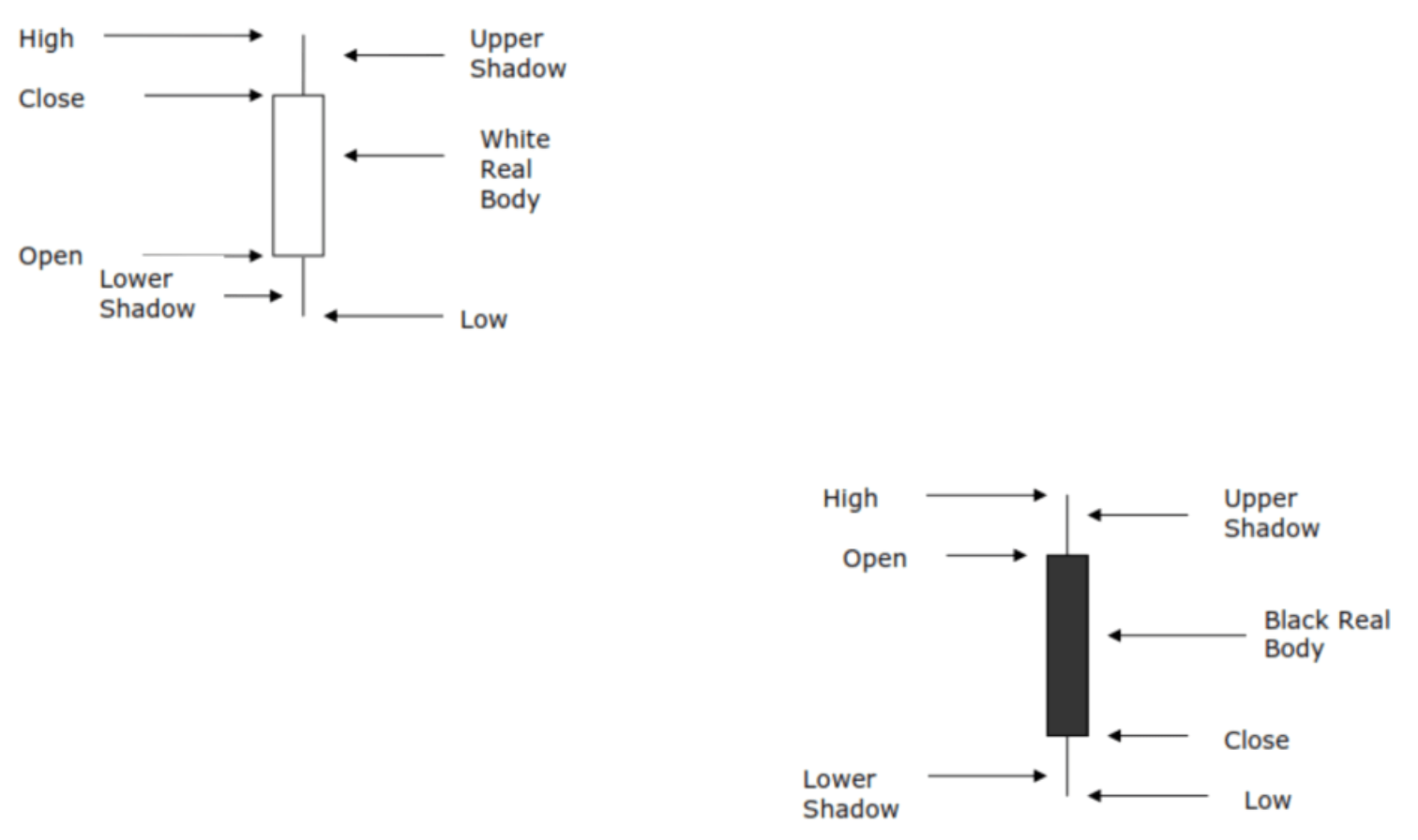

So, what is a candlestick?

A candlestick is a thin vertical line showing the period’s trading range. The wide bar on the vertical line indicates the difference between the open and the close. Check out the image below for an illustration of this concept:

In the sample above, the white candle in the upper left corner shows a bullish candle. In the lower right corner there is a black candle, which indicates a bearish sentiment.

There are a lot of different types of candlesticks. They are used by price action traders in order to read the market and take better trading decisions. For a detailed article on the topic visit Candlesticks Explained Here.

In order to show how they are used in conjunction with price action, let’s take an example from AUDUSD:

In this example above we have two of the most popular candlestick patterns- the bullish/bearish engulfing and an inside bar. What price action traders are looking for is a confirmation with a support/resistance level.

As you can see from the above example, the first bearish engulfing pattern appeared just below the resistance area. After that price started going lower and lower

On the other side, the inside bar formed on a support level. The confluence of candlesticks and support and resistance is probably the most well known technique for trading strictly price action.

Some traders claim that indicators can improve trading results, but for me (although I have covered a lot of indicators in details) could be just a nice addition, but nothing more. So, in the end, are indicators really necessary?

No Indicators

Although, price action trading does not recognise the use of indicators, it is important that we mention a few of the more famous ones, so that we have an objective view on that matter. Some of the most common trading indicators are:

I have written a separate article for each of these indicators, because of the complexity of the matter.

There are other indicators that are used by traders, but not really price action traders. So, let’s concentrate on what is important for price action trading and move on to the next section- timeframes.

Timeframes

Timeframes take a major place in each price action trader’s mind.

As a rule of a thumb, the higher the timeframe, the more accurate the signal. I must agree with this old saying and say that for me the Daily timeframe works probably best.

Other popular timeframes that I use are 4H and very rarely 60 minutes.

Price action traders do use all timeframes from 1 minute charts to monthly. If I had to chose between two traders to manage my money and I know one is using 1 minute charts and the other monthly, I would certainly go with the latter one.

Another very popular saying is that the lower the timeframe, the more noisy the signal, i.e. the less accurate.

In my opinion, the best way to use timeframes in price action is in confluence. In other words, use one timeframe for signal and a lower one for a more precise entry.

For me the combination between Daily/4Hour works best. I have been using it for many years and it has proven its qualities to not only me, but also everyone who has taken my trading course, which shows the exact price action strategy I use.

Does it matter which instrument I will trade?

One of the more common question amongst beginner price action traders is which instrument to start trading with.

Whether you start with the EURUSD or with AUDUSD, it won’t make a huge difference. For some trading approaches, it is easier to learn one instrument and master it. For me (and I believe for price action traders, too) what matters more is not so much the instrument, but the trend and the confirmation from price action.

As I’ve outlined above, it is important to wait for the right setup at the right time. It comes with practice, but if you are a beginner price action trader, you’d be better off with some Demo practice before you move to a real account.

The markets that I am using price action are:

Major/Minor FOREX pairs

US/EU Indices

Stocks

Commodities

I don’t trade with stocks currently, since I find the FOREX market more fascinating, but they could also be traded successfully with price action. One of the first factors for successful trading is to determine the major trend first and try to stay with it. As they say: “Trend is your friend”

Determine The Trend

Trend is your friend. This holds especially true for price action traders.

The best scenario for entering a profitable trade would be to:

- Have an established trend

- Have a correction for a previous support/resistance level

- Get a price action signal

Let’s try to visualise the above points by showing a chart of the GBPUSD:

And now, I will zoom-in, so you can see better where the price action confirmation comes in:

You can clearly see in the image above that there is an inside day candlestick formation which gives the confirmation for a trade in the direction of the trend. After this pattern, price starts going lower and lower.

Do I trade Ranges?

After writing about the trend, a logical question a lot of you will ask is if you should trade ranges.

Statistics is showing that markets do trade in ranges about 80% of the time. This somehow answers your question about trading the range.

One thing to notice here is that if you are trading a range, your targets should be much lower and more realistic.

Ideally, you should always be looking for trading according to the major trend. But this does not happen in the real world of trading. or at least- not that often. Therefore, I will show an example of trading the range below.

The image above is the daily chart of USDJPY. I have marked every time price reaches to the support and resistance levels from 1-6. Most of those times, we have a trading confirmation from price action:

- Inside Bar

- Bearish Engulfing

- Pinbar

- Pinbar

- Not clearly defined

- Pinbar

From all of those patterns, we can see that only #5 is not clearly defined. The rest are working great. This example shows us what profitable range trading looks like and how price action traders are utilising it.

Do price action traders use other tools in confluence with price action? – Fibo; Moving Averages; Pivot points

Price action traders have different trading techniques. It is hard to really narrow down price action trading to black and white squares. Some of the more popular techniques are:

- Using price action analysis in conjunction with Fibonacci levels.

- Using price action with Moving Averages

- Price action traders also use other tools and levels also known as Pivot points

It is hard to say how successful those different techniques are, since I am not really using them. I have written in more details explaining how they work, but I try not to mix too many elements in my price action analysis.

Patience pays back

How many of you have heard of the fable “The Tortoise and the Hare”?

For price action traders, it is crucial that they are patient. Trading opportunities will always be there, but your capital is your scarce resource and your only asset.

That is why, the best way win in this game is to be patient.

A lot of new traders are scared that if they miss one opportunity, another one won’t come around. I have

If you are still not sure how you can take advantage of missed opportunities, I have created a special article for this purpose. Check how to get on a trade that you have initially missed. One way or another, my suggestion is to just wait for a fresh opportunity and take things from there.

Role of Money Management

Money management is undeniably the king of successful trading.

Two traders using the same trading system and different money management approaches might have strikingly different results. They could be so striking, that one of the traders could be an extremely profitable trader, while the other one is blowing out his/her account overnight.

It is important to know how to manage your risk properly, especially when trading with price action. Indeed, it is probably even easier to do so when using this type of trading. For a specially dedicated article on that topic, visit my Proper Money Management article, where I do share a risk calculator for FREE, as well.

As a rule of a thumb, a trader should never risk more than 2% of his/her capital on a single trade. I do risk only 0.5% of my capital on a trade. I prefer to be wrong 70% of the time and hit a home-run on 30% of the trades. What is important once again is the time you stick to your profitable trades and how fast you get rid of losers.

Summary

Trading is a long journey. This article’s aim was to summarise all the important topics from the world of price action trading. I have tried to walk you through different examples and ways that price action traders use to profit from the markets nowadays.

If I have to summarise price action trading in 5 bullet points, they will be:

- Clean charts

- Support and Resistance

- Candlesticks

- Trend

- Timeframe

These 5 price action points are helping us stay outside of trouble. Let’s not forget about money management and we are almost there. If you are interested in learning the whole process of how I see price action and use it in my daily trading, you can check out my professional trading course. It aims to help beginner and experienced traders alike.

Let’s summarise again in a printable version, so you can save it and print it for your ease:

p.s.

Here is a short extract from my price action trading professional course:

Helpful to learn something for me,who don’t know about market&trying to learn something@52+

Glad to be helpful!